For the 24 hours to 23:00 GMT, USD strengthened 0.53% against the JPY and closed at80.32.

In Japan, yesterday, the consumer sentiment index rose to a reading of 34.2 in May, following a reading of 33.1 posted in the previous month. The machine tool orders rose by 34.2% (Y-o-Y) in May, following a 32.3% increase recorded in April.

Ratings agency, Fitch Rating has warned the US for a possible credit downgrade if the debt ceiling is not raised by August 2.

Additionally, this morning, the tertiary industry activity index in Japan rose by 2.6% in April compared to a 6% decline in March. Meanwhile, the domestic corporate goods price index, on monthly basis, declined by 0.1% in May following a 0.9% increase in April.

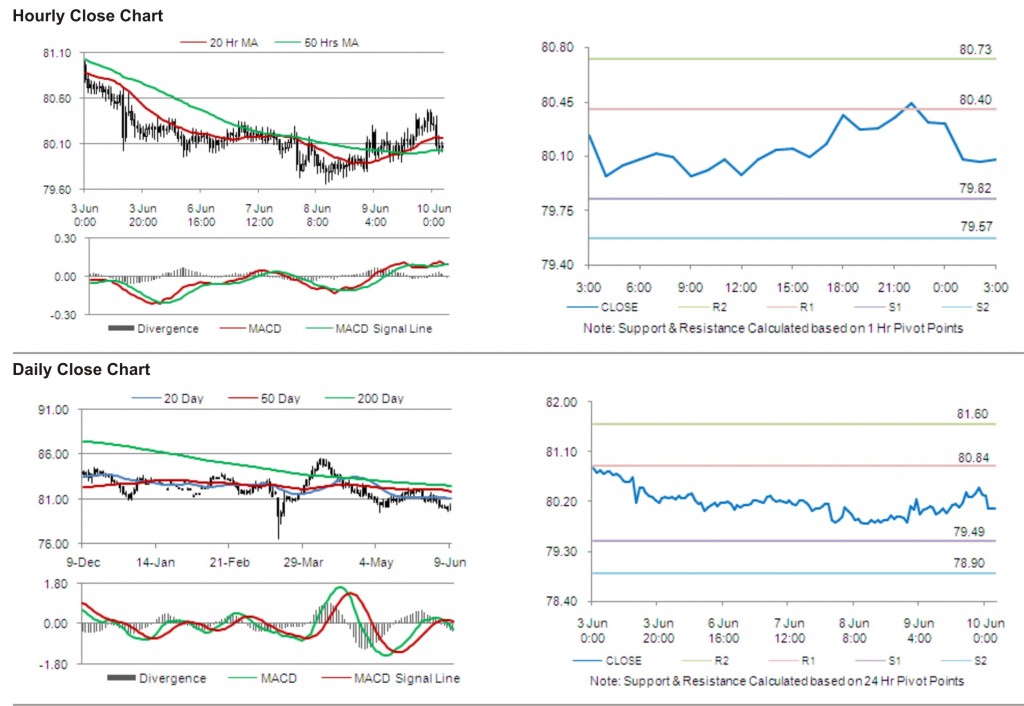

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.30% at 80.08.

The first short term resistance is at 80.40, followed by 80.73. The pair is expected to find support at 79.82 and the subsequent support level at 79.57.

The currency pair is showing convergence with its 50 Hr moving average and is trading just below its 20 Hr moving average.