For the 24 hours to 23:00 GMT, EUR declined 0.54% against the USD and closed at 1.4513.

The European Central Bank (ECB) maintained its key interest rate unchanged at 1.25%, matching market estimates, and rejected any direct participation by the bank in a second bailout for Greece. Additionally, the rate on the marginal lending facility was retained at 2.0%, while the rate on the deposit facility was left unchanged at 0.5%.

The European Central Bank President, Jean-Claude Trichet, signaled a rate hike as early as next month. He also added that ‘strong vigilance is warranted’, citing upside risks to the outlook for price stability.

EUR was pressurized after Moody’s Investors Service stated that it would be hard to imagine private creditors participating voluntarily in a debt restructuring, any Greek default would also impact the credit ratings of other bailed out countries.

In Germany, the labor cost per hour, on a seasonally and calendar adjusted sequential basis, increased by 2.0% in the first quarter of 2011, the second-biggest increase since inception.

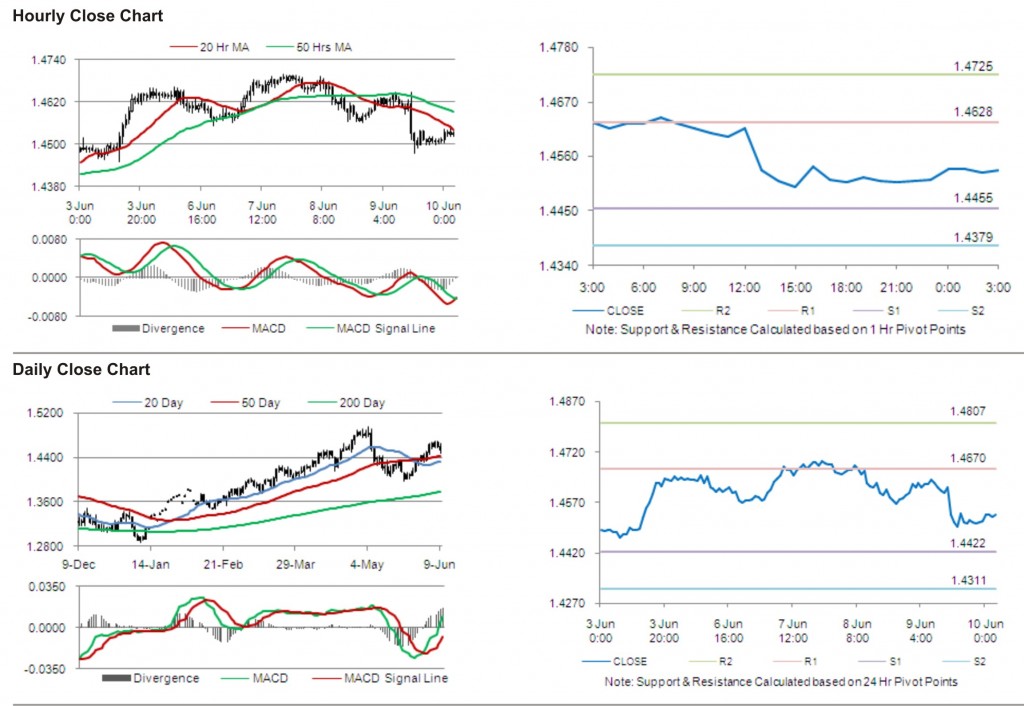

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4532, 0.13% higher from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4628, followed by the next resistance at 1.4725. The first support is at 1.4455, with the subsequent support at 1.4379.

Trading trends in the pair today are expected to be determined by release of consumer price index in Germany.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.