For the 24 hours to 23:00 GMT, USD strengthened 0.46% against the JPY and closed at 80.53.

The Bank of Japan board voted unanimously to maintain its unsecured overnight call loan rate target unchanged in a range of 0.0%-0.1%.

The Bank of Japan (BoJ) has decided to expand its lending program aimed at boosting growth in high-potential industries by ¥500.0 billion and to further relax conditions under which it provides the funds. Additionally, the central bank slightly upgraded its assessment of the domestic economy, indicating that “Japan’s economy continues to face downward pressure, mainly on the production side due to the effects of the earthquake disaster but is showing some signs of picking up.”

Additionally, the industrial production, on monthly basis, rose by 1.6% in April from 1.0% rise in the previous month. Meanwhile, the capacity utilization, on monthly basis increased to -1.1% in April from -21.5% in the previous month.

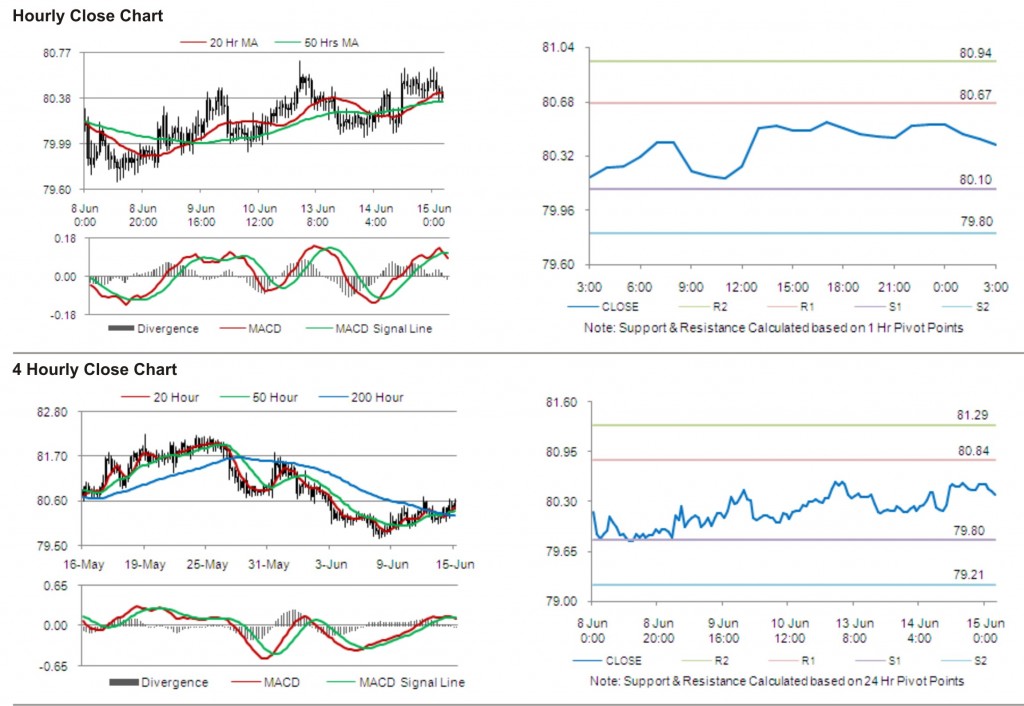

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.17%, at 80.39.

The first short term resistance is at 80.67, followed by 80.94. The pair is expected to find support at 80.10 and the subsequent support level at 79.80.

The currency pair is showing convergence with its 50 Hr moving average and is trading just below its 20 Hr moving average.