For the 24 hours to 23:00 GMT, GBP rose 0.10% against the USD and closed at 1.6380, after the inflation report in the UK raised speculation that the Bank of England would raise interest rates.

In the UK, the consumer prices, on monthly basis, rose by 0.2% in May compared to 1.0% increase in April. The Department of Communities and Local Government (DCLG) reported that, on an annual basis, the house price index declined 0.3% in April, the first drop in house prices since October 2009, following a 0.9% increase recorded in March.

Meanwhile, the retail price index rose by 0.3% (M-o-M) in May from 0.8% rise in April. Additionally, the leading economic index rose by 0.4% (M-o-M) in April, following a 0.5% increase recorded in the previous month. The Nationwide consumer confidence index rose to a reading of 55.0 in May, the largest jump since November 2005, following an upwardly revised reading of 44.0 posted in April.

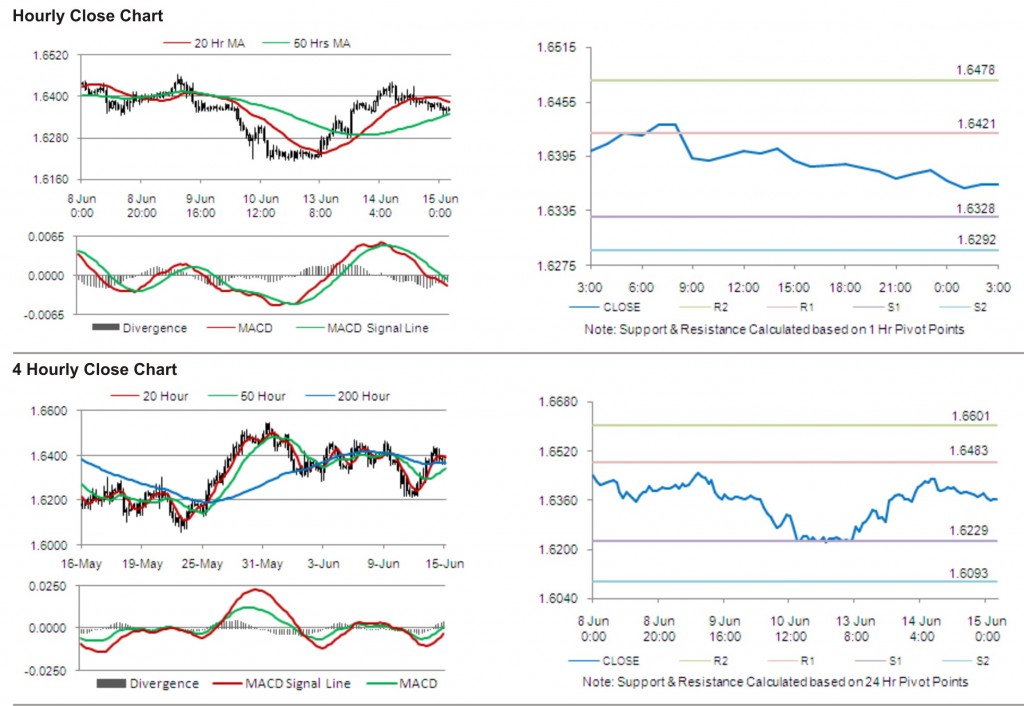

The pair opened the Asian session at 1.6380, and is trading at 1.6364 at 3.00GMT. The pair is trading 0.10% lower from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6421, followed by the next resistance at 1.6478. The first support is at 1.6328, with the subsequent support at 1.6292.

With a series of UK economic releases today, including claimant count rate and ILO unemployment rate, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading between its 20 Hr moving average and its 50 Hr moving average.