For the 24 hours to 23:00 GMT, the GBP rose marginally against the USD and closed at 1.2240.

Data indicated that UK’s manufacturing sector expanded at a slower-than-expected pace of 54.3 in October, compared to market expectations for it to advance to a level of 54.5 and following a revised reading of 55.5 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.2237, with the GBP trading slightly lower against the USD from yesterday’s close.

Overnight data showed that the BRC shop price index eased by 1.7% YoY in October, following a drop of 1.8% in the prior month.

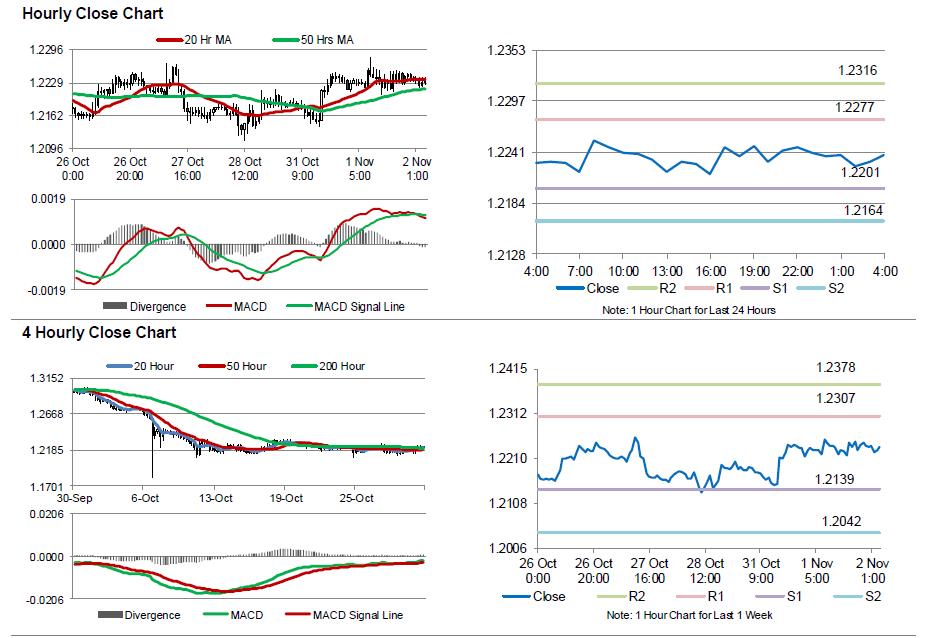

The pair is expected to find support at 1.2201, and a fall through could take it to the next support level of 1.2164. The pair is expected to find its first resistance at 1.2277, and a rise through could take it to the next resistance level of 1.2316.

Moving ahead, UK’s Markit construction PMI and Nationwide house price index, both for October, scheduled to release in a few hours, would be on investor’s radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.