For the 24 hours to 23:00 GMT, the EUR rose 0.84% against the USD and closed at 1.1056.

In the US, data indicated that the ISM manufacturing activity index advanced for a second straight month to a level of 51.9 in October, hitting its highest level in three-months, indicating that the manufacturing sector is showing signs of stability, after struggling to grow over the past year. Markets expected the index to rise to a level of 51.7, following a reading of 51.5 in the previous month. Additionally, the nation’s final Markit manufacturing PMI rose more-than-expected to a level of 53.4 in October, marking its highest level in one year, compared a preliminary reading of 53.2 and after registering a reading of 51.5 in the prior month. Further, the nation’s IBD/TIPP economic optimism index unexpectedly rose to a level of 51.4 in November, compared to a reading of 51.3 in the prior month and defying market consensus for the index to ease to a level of 49.0. On the contrary, the nation’s construction spending surprisingly dropped by 0.4% on a monthly basis in September, confounding market expectations for a rise of 0.5% and after recording a revised drop of 0.5% in the prior month.

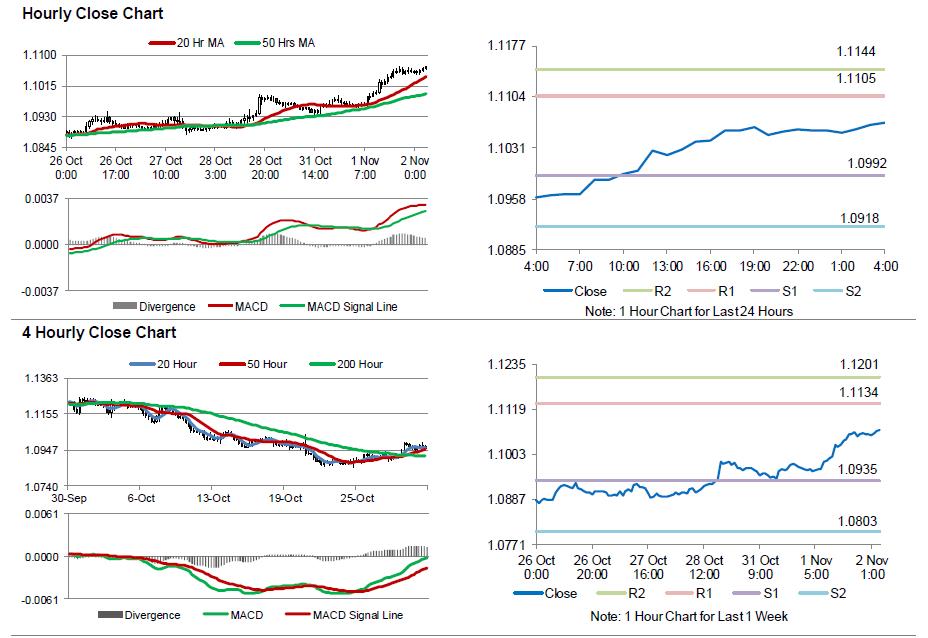

In the Asian session, at GMT0400, the pair is trading at 1.1067, with the EUR trading 0.1% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0992, and a fall through could take it to the next support level of 1.0918. The pair is expected to find its first resistance at 1.1105, and a rise through could take it to the next resistance level of 1.1144.

Looking ahead, market participants would closely monitor final Markit manufacturing PMI across the Euro-zone along with Germany’s unemployment rate, both for October, slated to release in a few hours. Additionally, all eyes would be on the release of the latest Federal Reserve policy meeting and interest rate decision, due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.