For the 24 hours to 23:00 GMT, GBP fell 0.95% against the USD and closed at 1.6060.

The minutes released yesterday, from the Bank of England’s most recent meeting showed that more policy makers voted to keep interest rates at a record low this month. The members voted 7-2 to keep rates unchanged at 0.5%.

The Bank of England’s (BoE) Governor, Mervyn King, indicated that the sovereign debt crisis in the Euro-zone is the biggest risk to the European Union’s (EU) financial system.

The pair opened the Asian session at 1.606, and is trading at 1.6044 at 3.00GMT. The pair is trading 0.10% lower from yesterday’s close at 23:00 GMT.

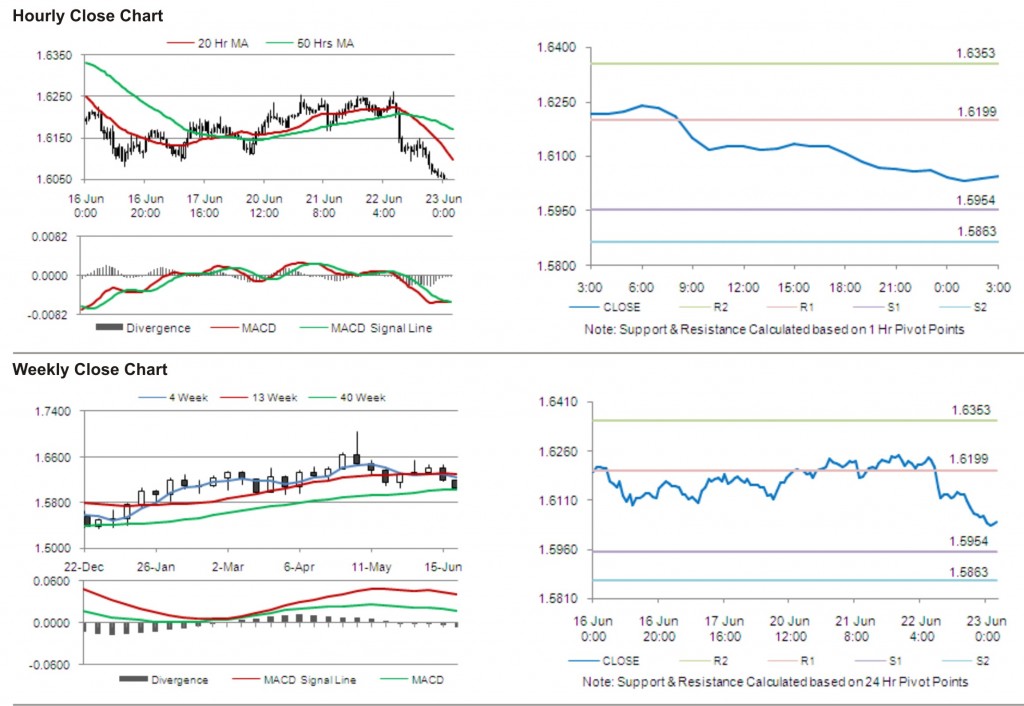

The pair has its first short term resistance at 1.6199, followed by the next resistance at 1.6353. The first support is at 1.5954, with the subsequent support at 1.5863.

Trading trends in the pair today are expected to be determined by data release on continuing jobless claims and mortgage approvals in the UK.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.