For the 24 hours to 23:00 GMT, EUR declined 0.29% against the USD and closed at 1.4324.

The US dollar surged against its majority counterparts, after the Federal Reserve Chairman, Ben Bernanke gave no indication that they would embark on a third round of quantitative easing in support of the struggling economy. He further stated that the economic recovery appears to be proceeding at a moderate pace, though the pace is slower than the committee had expected.

In the Euro zone news, the European Central Bank President Jean-Claude Trichet stated that risk signals for financial stability in the euro area are flashing “red” as the debt crisis threatens to infect banks.

In the economic news, the industrial new orders in the Euro zone increased by 0.7% (M-o-M) in April in comparison with the 1.5% decline in March. Additionally, the consumer confidence dropped to -10.0 in June, following a downwardly revised reading of -9.9 recorded in May.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4310, 0.10% lower from the levels yesterday at 23:00GMT.

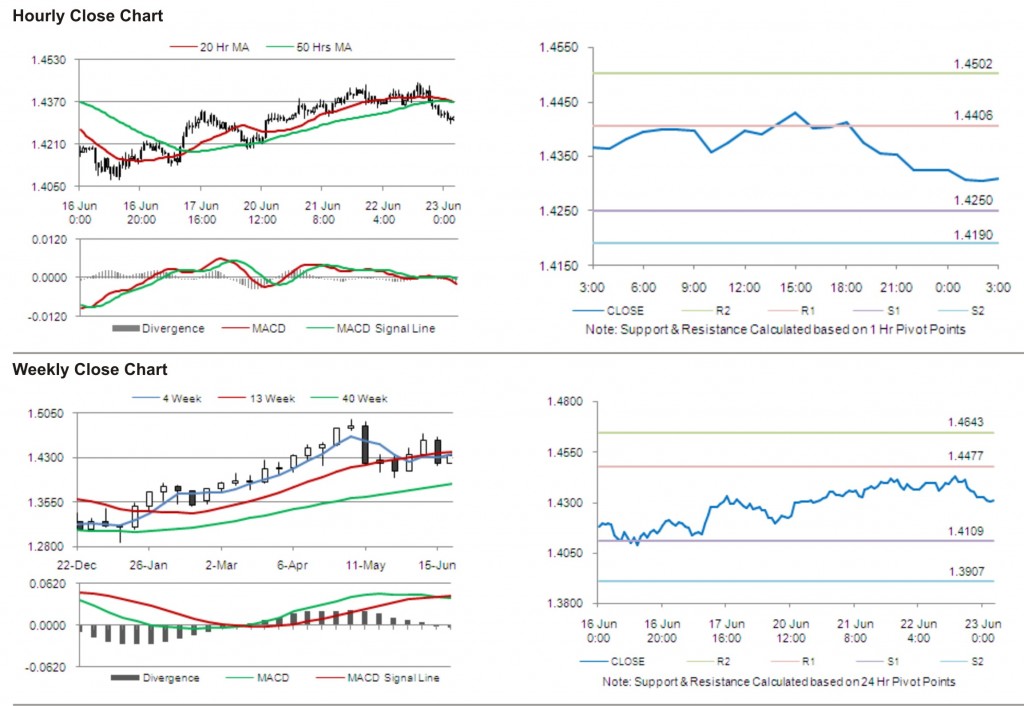

The pair has its first short term resistance at 1.4406, followed by the next resistance at 1.4502. The first support is at 1.4250, with the subsequent support at 1.4190.

Trading trends in the pair today are expected to be determined by release of manufacturing purchasing manager index manufacturing in the Euro zone.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.