For the 24 hours to 23:00 GMT, GBP rose 0.54% against the USD and closed at 1.6072.

In the UK, on a seasonally adjusted annual basis, the money supply declined by 0.2% in May, the eight consecutive decline, following a 0.9% fall recorded in the previous month. The services index declined by 1.2% (M-o-M) in April, the biggest decline since January 2010, following a 0.8% growth recorded in the previous month. The number of loans approved for house purchases increased to 45,940 in May, compared to total mortgage approvals of 45,447 recorded in April. The Gfk consumer confidence declined to -25 points in June from -21 points in May.

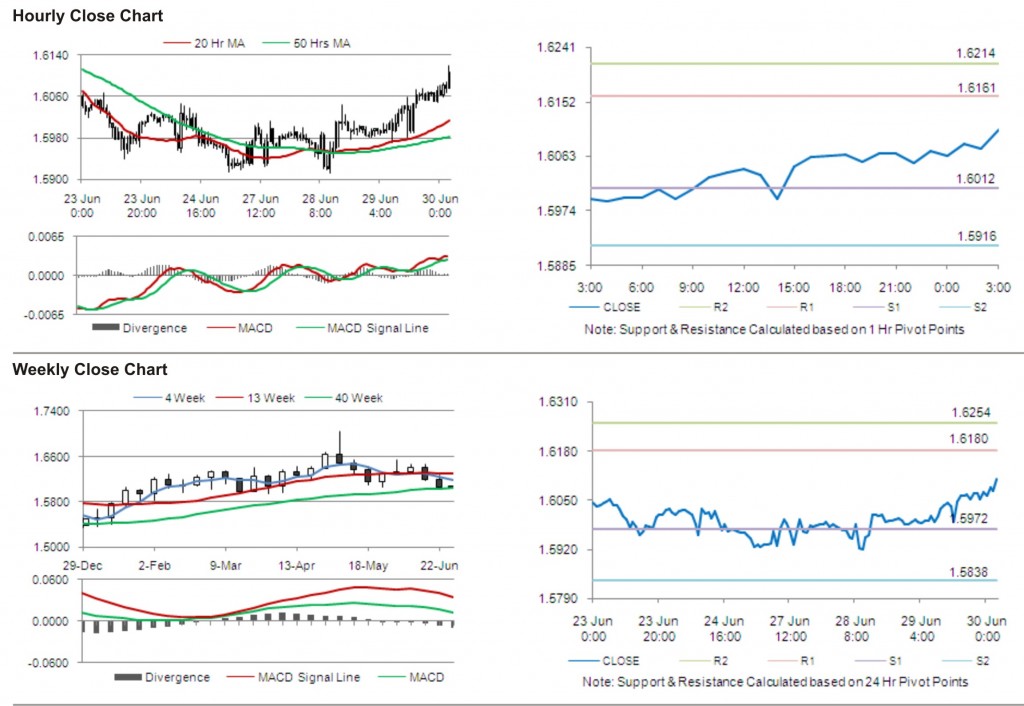

The pair opened the Asian session at 1.6072, and is trading at 1.6107 at 3.00GMT. The pair is trading 0.22% higher from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6161, followed by the next resistance at 1.6214. The first support is at 1.6012, with the subsequent support at 1.5916.

The pair is expected to trade on the cues from the release of Bank of England credit conditions report and nationwide housing prices in the UK.

The currency pair is trading well above its 20 Hr and its 50 Hr moving averages.