For the 24 hours to 23:00 GMT, USD weakened 0.46% against the JPY and closed at 80.72.

Yesterday, the Japanese Yen found support in better than expected rebound in the country’s industrial production. In May, Japan’s industrial production grew by 5.7%, compared to a month earlier, significantly higher than 1.6% recorded in April.

In Japan, this morning, the manufacturing purchasing manager index declined to 50.7 points in June from 51.3 points in May.

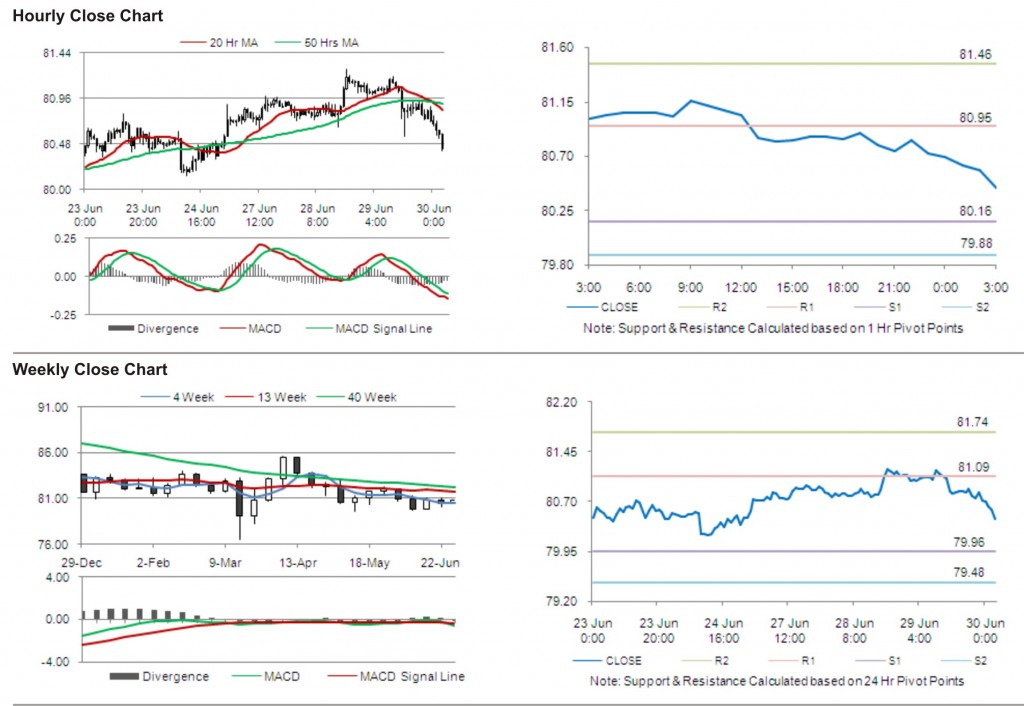

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.36%, at 80.43.

The first short term resistance is at 80.95, followed by 81.46. The pair is expected to find support at 80.16 and the subsequent support level at 79.88.

With a series of Japan economic releases today, including unemployment rate and consumer price index, trading in the pair is expected to be influenced by the resulting cues.

The currency pair is trading well below its 20 Hr and its 50 Hr moving averages.