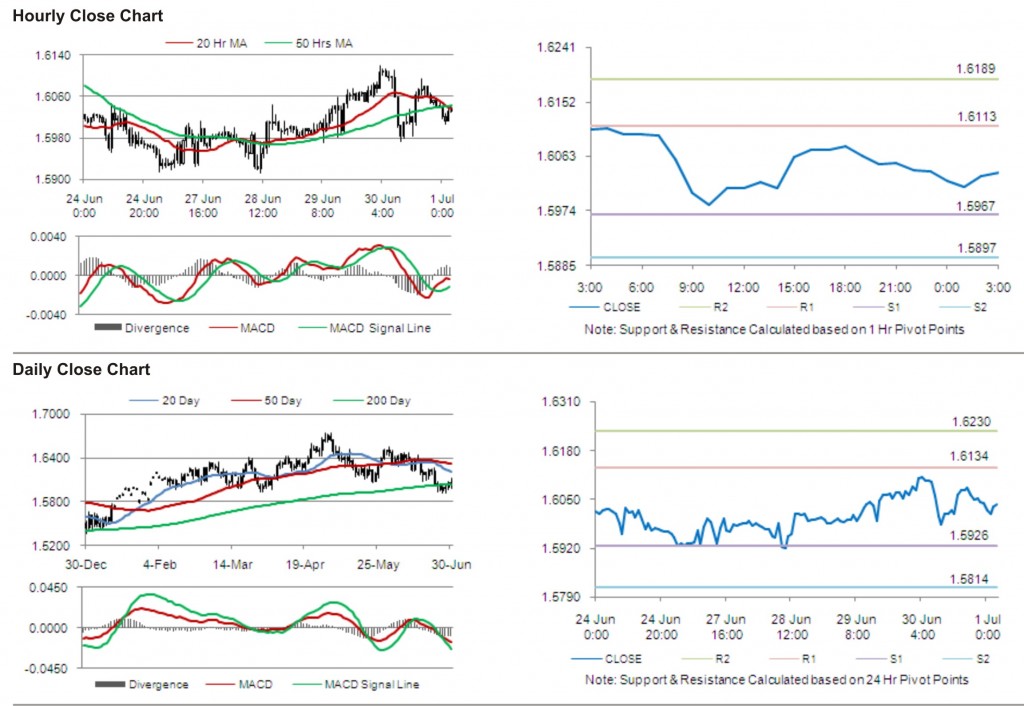

For the 24 hours to 23:00 GMT, GBP fell 0.21% against the USD and closed at 1.6038.

In the Bank of England credit conditions report, the UK banks stated that demand for mortgages would probably fall in the third quarter after increasing “a little” in the three months through June. The report also stated that banks expect default rates to increase in the third quarter after they were “broadly unchanged” in the second.

In the UK, the nationwide housing prices remained unchanged in June, in comparison with 0.3% growth in May.

The pair opened the Asian session at 1.6038, and is trading at 1.6037 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6113, followed by the next resistance at 1.6189. The first support is at 1.5967, with the subsequent support at 1.5897.

Trading trends in the pair today are expected to be determined by Purchasing Manager Index (PMI) in the UK.

The currency pair is showing convergence with its 20 Hr moving average and its 50 Hr moving average.