For the 24 hours to 23:00 GMT, EUR rose 0.10% against the USD and closed at 1.4488, on investors’ speculations that the European Central Bank would raise interest rates next week to curb inflation and as Greece’s Parliament voted “yes” for austerity measures.

The Greek Parliament passed the second austerity bill yesterday by 155 votes to 136, which means that the country is now eligible to receive the fifth tranche of the bailout funds from the EU and IMF which would help it avoid debt default.

In the Euro zone economic news, the money supply, on annual basis, increased by 2.4% in May following a 2.0% increase in April. The consumer price inflation, on annual basis, remained unchanged at 2.7% in June.

Meanwhile, European Central Bank President, Jean Claude Trichet continued to profess strong vigilance on inflation, strongly hinting that the ECB would hike interest rates next week.

Additionally, in German economic news, retail sales declined by 2.8% (M-o-M) in May, following 0.3% growth in April. The jobless rate remained unchanged at 7.0% in June.

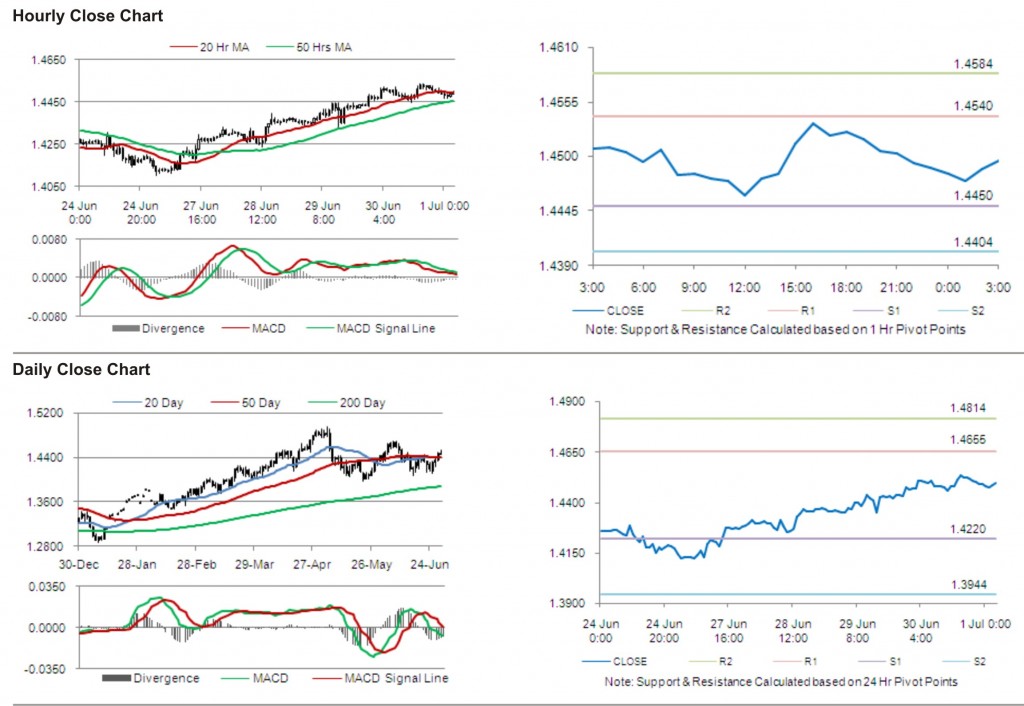

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4496, 0.06% higher from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4540, followed by the next resistance at 1.4584. The first support is at 1.4450, with the subsequent support at 1.4404.

Trading trends in the pair today are expected to be determined by data release on Purchasing Manager Index(PMI) and unemployment rate in the Euro zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.