For the 24 hours to 23:00 GMT, EUR declined 0.48% against the USD and closed at 1.3969, as a downgrade to Ireland’s credit ratings fuelled concerns that the European debt crisis would deepen.

Moody’s Investors Service downgraded Ireland’s foreign- and local-currency government bond ratings by one notch to non-investment grade of Ba1 from Baa3, while its short-term issuer rating was downgraded by one notch to Non-Prime from Prime-3.

In the economic news, the annual consumer price inflation in Germany stood at 2.3% (Y-o-Y) in June, matching initial estimates.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.3997, 0.20% higher from the levels yesterday at 23:00GMT.

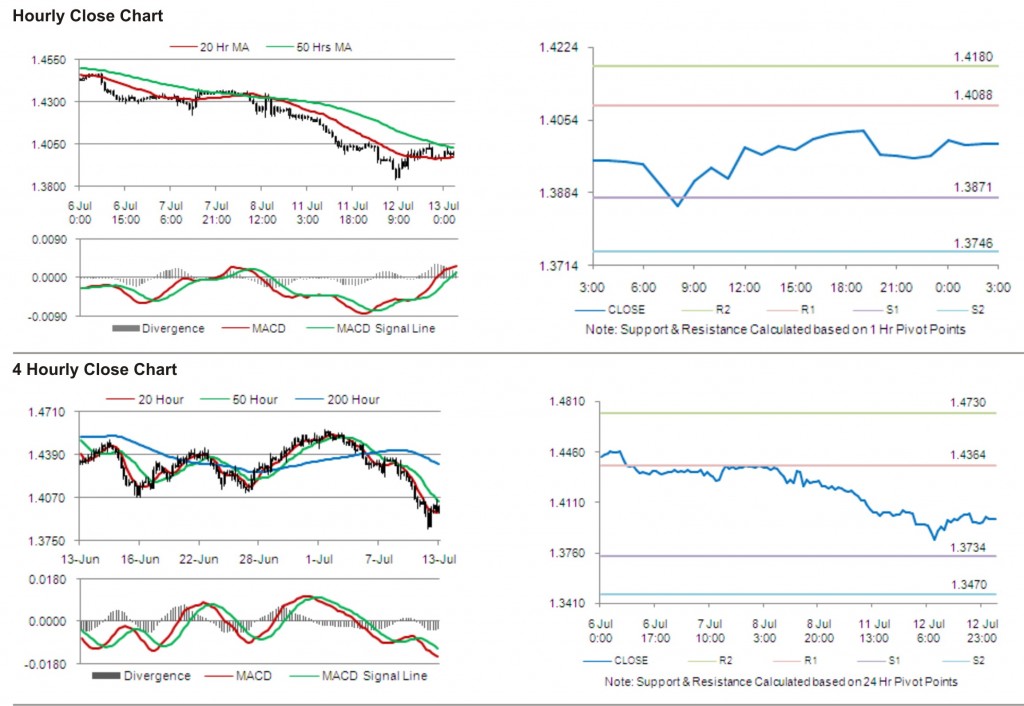

The pair has its first short term resistance at 1.4088, followed by the next resistance at 1.4180. The first support is at 1.3871, with the subsequent support at 1.3746.

Trading trends in the pair are expected to be determined by release of industrial production data in the Euro zone, later today.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.