For the 24 hours to 23:00 GMT, GBP rose 0.10% against the USD and closed at 1.5917.

In the UK, the consumer price inflation, on an annual basis, declined to 4.2% in June, following a rate of 4.5% recorded in May. The retail price inflation declined to 5.0% (Y-o-Y) in June, compared to a rate of 5.2% in May. The leading index rose by 0.6% (M-o-M) in May, following a 0.4% gain recorded in April. Meanwhile the trade deficit widened to £8.5 billion in May, following a revised deficit of £7.6 billion recorded in April.

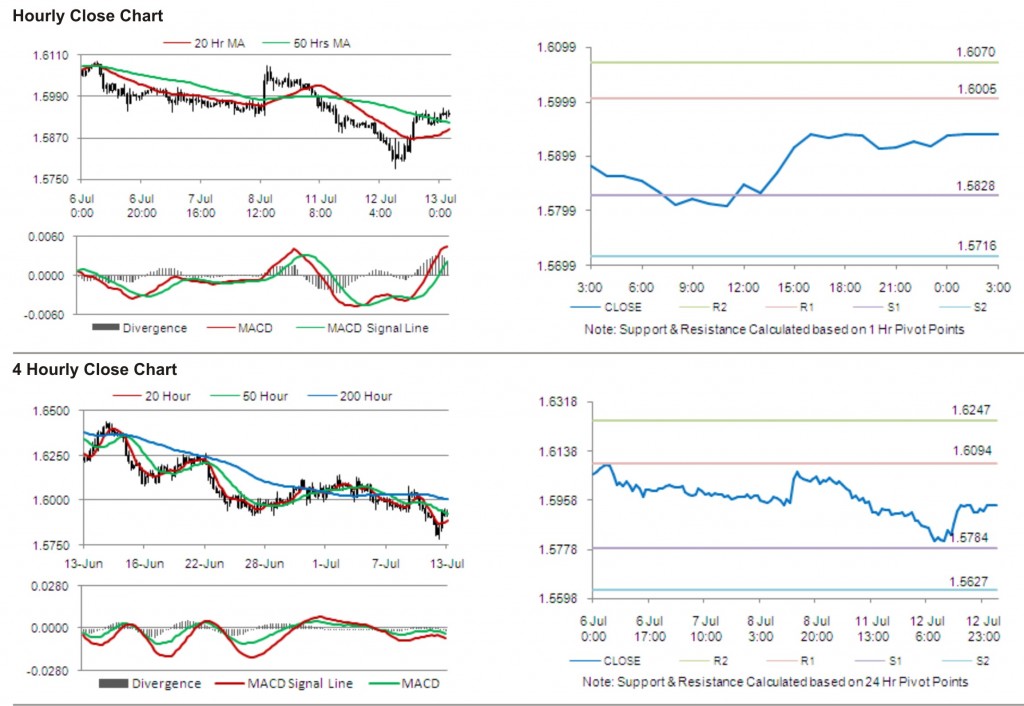

The pair opened the Asian session at 1.5917, and is trading at 1.5940 at 3.00GMT. The pair is trading 0.14% higher from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6005, followed by the next resistance at 1.6070. The first support is at 1.5828, with the subsequent support at 1.5716.

With a series of UK economic releases today, including unemployment rate and claimant count change, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.