For the 24 hours to 23:00 GMT, the GBP declined 0.67% against the USD and closed at 1.3100.

On the macro front, UK’s consumer price index (CPI) rose 2.4% on an annual basis in September, falling short of market expectations for a gain of 2.6%. In the previous month, the CPI had advanced 2.7%. Additionally, Britain’s retail price index unexpectedly fell 3.3% on a yearly basis in September, defying market consensus for an unchanged reading. The index had climbed 3.5% in the prior month.

On the contrary, the nation’s house price index jumped 3.2% on an annual basis in August, more than market anticipation for a climb of 2.8%. The index had recorded a revised rise of 3.4% in the previous month.

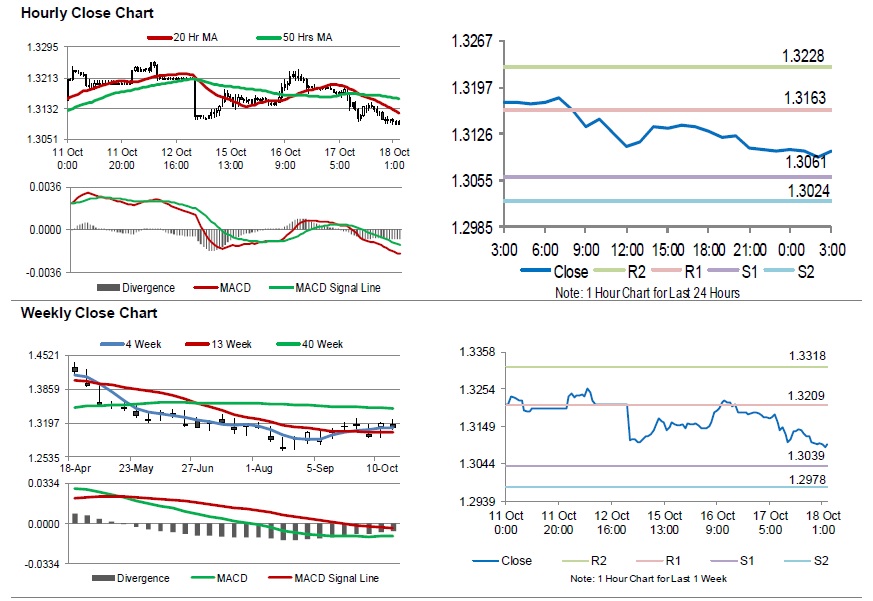

In the Asian session, at GMT0300, the pair is trading at 1.3099, with the GBP trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3061, and a fall through could take it to the next support level of 1.3024. The pair is expected to find its first resistance at 1.3163, and a rise through could take it to the next resistance level of 1.3228.

Looking forward, investors await UK’s retail sales data for September, set to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.