For the 24 hours to 23:00 GMT, the EUR declined 0.66% against the USD and closed at 1.1500.

Macroeconomic data showed that the Euro-zone’s final consumer price index (CPI) increased 2.1% on yearly basis in September, in line with market expectations. The CPI had climbed 2.0% in the previous month, while the preliminary figures had indicated an advance of 2.0%. On the other hand, the region’s seasonally adjusted construction output eased of 0.5% on a monthly basis in August, after a revised decline of 0.1% in the prior month.

In the US, data revealed that the US building permits unexpectedly dropped 0.6%, on a monthly basis, to an annual rate of 1241.0K, defying market expectations for a rise to a level of 1257.0K. In the preceding month, the building permits recorded a revised level of 1249.0K. Moreover, the nation’s housing starts slid 5.3%, on a monthly basis, to an annual rate of 1201.0K in September, reflecting damages due to the Hurricane Florence. Market participants had envisaged the housing starts to record a reading of 1210.0K, while housing starts had registered a revised level of 1268.0K in the prior month.

The minutes of the Federal Reserve’s Open Market Committee September meeting showed that policymakers expressed confidence over the further gradual interest rate hikes and unanimously agreed to maintain the interest rate between 2% and 2.25%. Furthermore, the committee continued to remain consistent for the further prospects of a fourth 2018 hike in December as the members had anticipated a further gradual increase in the target range for the federal funds rate.

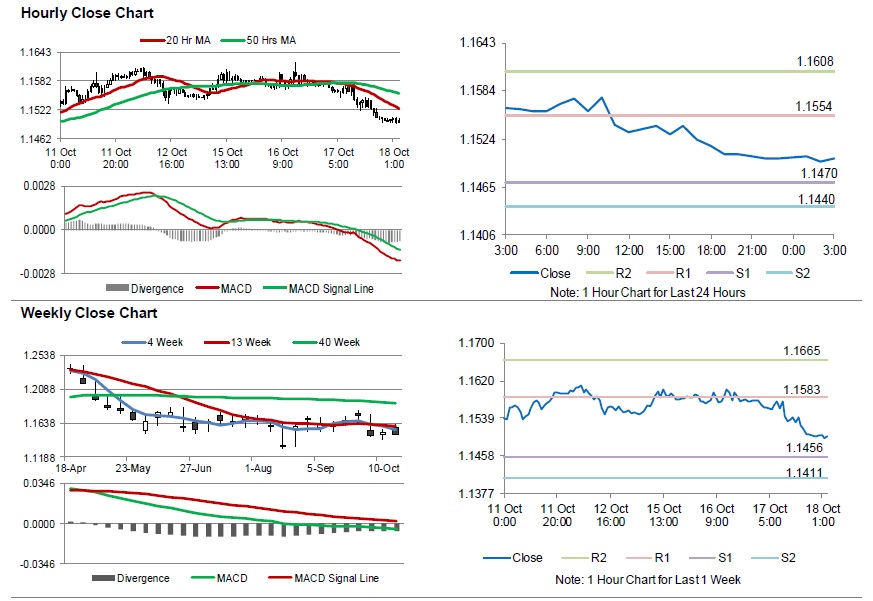

In the Asian session, at GMT0300, the pair is trading at 1.1500, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1470, and a fall through could take it to the next support level of 1.1440. The pair is expected to find its first resistance at 1.1554, and a rise through could take it to the next resistance level of 1.1608.

Amid lack of macroeconomic releases in the Euro-zone today, traders look forward to the US initial jobless claims followed by Philadelphia fed business outlook for October and leading index for September, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.