For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1397, amid concerns over Euro-zone’s growth outlook.

Data revealed that Germany’s final consumer price index (CPI) eased 1.7% on a yearly basis in December, marking its lowest level in 8-months and meeting market expectations as well as confirming the preliminary print. In the prior month, the CPI had registered a rise of 2.3%.

In the US, data showed that the US NAHB housing market index unexpectedly rose to a level of 58.0 in January, rising for the first time in three months and supported by falling borrowing costs. Market participants had envisaged the index to record an unchanged reading. In the previous month, the index had recorded a level of 56.0. Also, the nation’s MBA mortgage applications climbed to an 11-month high level of 13.5% in the week ended 11 January 2019, following an increase of 23.5% in the preceding week.

The Federal Reserve’s Beige Book survey showed that the economy activity in most US districts reported a modest to moderate growth in December and early January. Further, the report indicated that labour markets tightened across the country and wages grew moderately. Additionally, the report signalled that optimism is fading among US businesses due to government shutdown, trade conflicts, higher borrowing costs and a volatile stock market.

In the Asian session, at GMT0400, the pair is trading at 1.1386, with the EUR trading 0.10% lower against the USD from yesterday’s close.

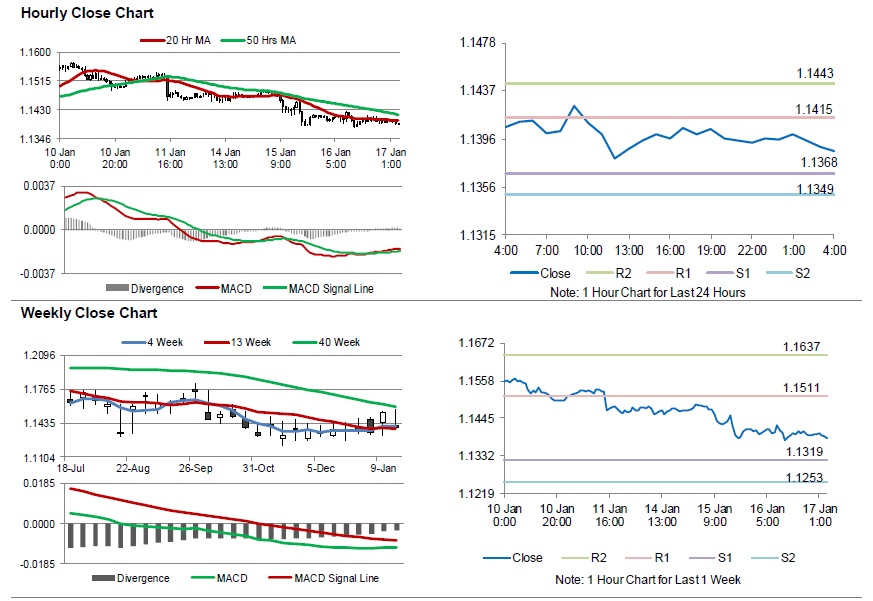

The pair is expected to find support at 1.1368, and a fall through could take it to the next support level of 1.1349. The pair is expected to find its first resistance at 1.1415, and a rise through could take it to the next resistance level of 1.1443.

Going forward, traders would await the Euro-zone’s construction output for November and the consumer price index for December, scheduled to release in a few hours. Later in the day, the US Philadelphia Fed business outlook for January, along with housing starts and building permits, both for December, will keep investor on their toes. Also, the US initial jobless claims will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.