For the 24 hours to 23:00 GMT, the GBP rose 0.30% against the USD and closed at 1.2880, after British Prime Minister, Theresa May won a no-confidence vote in the parliament.

Macroeconomic data showed that UK’s consumer price inflation (CPI) slowed to 2.1% on an annual basis in December, weighed down by declining fuel prices and air fares and notching its lowest level in nearly two years. In the previous month, the CPI had registered a rise of 2.3%. Moreover, Britain’s house price index rose 2.8% on an annual basis in November, falling short of market expectations for an advance of 3.0%. In the prior month, the index had recorded a gain of 2.7%. Additionally, the nation’s non-seasonally adjusted output producer price index (PPI) rose 2.5% on a yearly basis in December. In the previous month, the output PPI had registered a revised rise of 3.0%.

Separately, the Bank of England (BoE) Governor, Mark Carney, warned that financial markets are likely to remain volatile against the backdrop of Parliament’s rejection of the British Prime Minister, Theresa May’s Brexit plans.

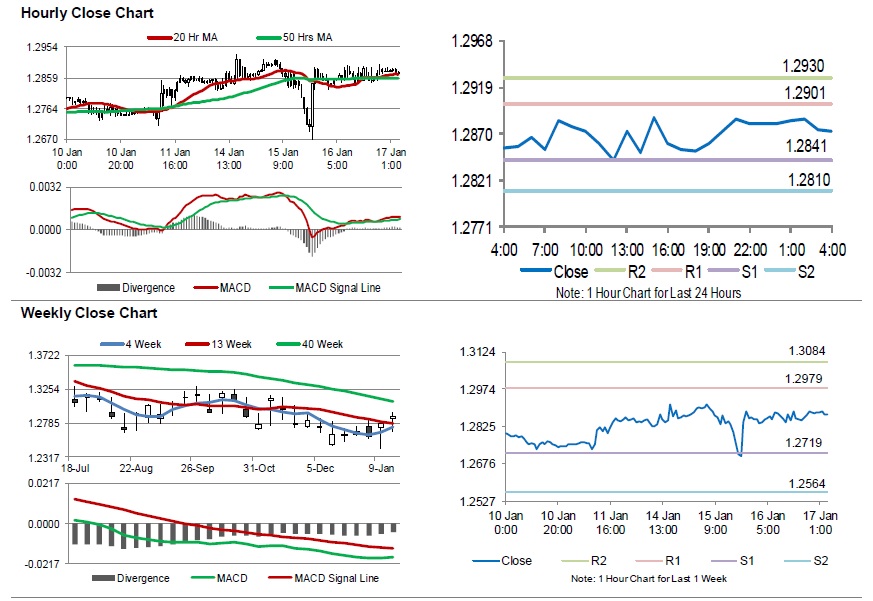

In the Asian session, at GMT0400, the pair is trading at 1.2873, with the GBP trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2841, and a fall through could take it to the next support level of 1.2810. The pair is expected to find its first resistance at 1.2901, and a rise through could take it to the next resistance level of 1.2930.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.