For the 24 hours to 23:00 GMT, USD declined 0.48% against the CHF and closed at 0.8015, amid concerns that the US may default on its debt next week.

In Switzerland, the UBS consumption indicator decreased to 1.48 in June, from 1.88 in May.

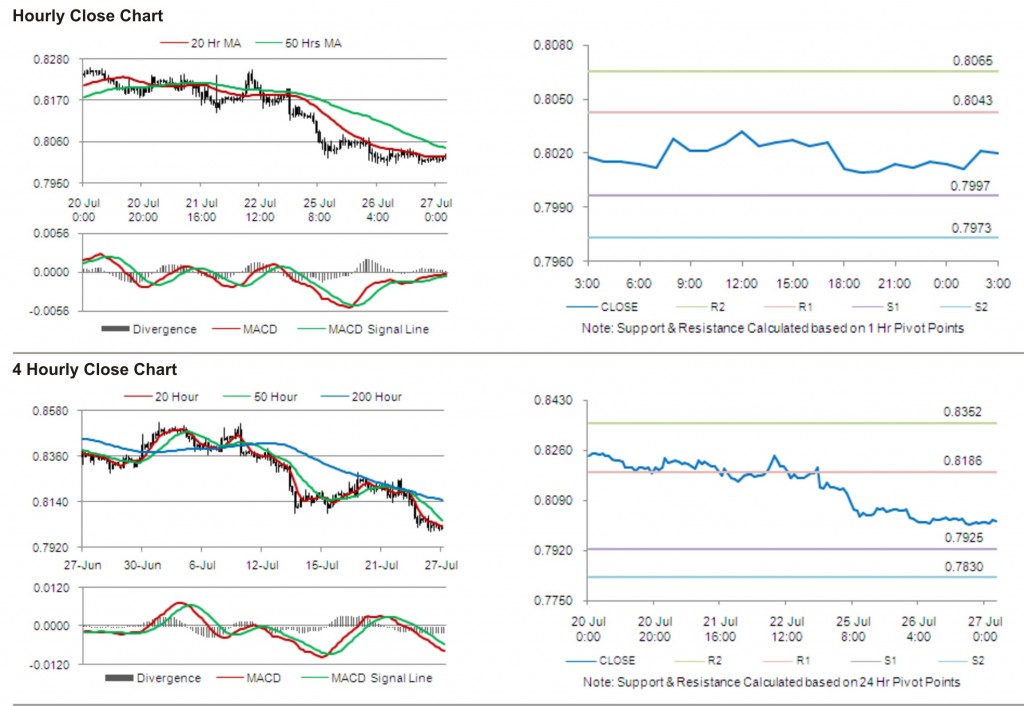

In the Asian session, at 3:00GMT, the pair is trading at 0.8020, 0.06% higher from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 0.8043, followed by the next resistance at 0.8065. The first area of support is at 0.7997 level, with the subsequent support at 0.7973.

Trading trends in the pair today are expected to be determined by release of KOF leading indicator in Switzerland.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.