For the 24 hours to 23:00 GMT, USD declined 0.39% against the CAD to close at 0.9434, as investors await a resolution to the debt impasse in the US.

In the US, the consumer confidence index rose to 59.5 in July, following a downwardly revised reading of 57.6 posted in June. Additionally, the Federal Reserve Bank of Richmond indicated that its manufacturing index declined to -1.0 in July, following a reading of 3.0 posted in June.

In the Asian session at 3:00GMT, the pair is trading at 0.9432, flat from yesterday’s close at 23:00 GMT.

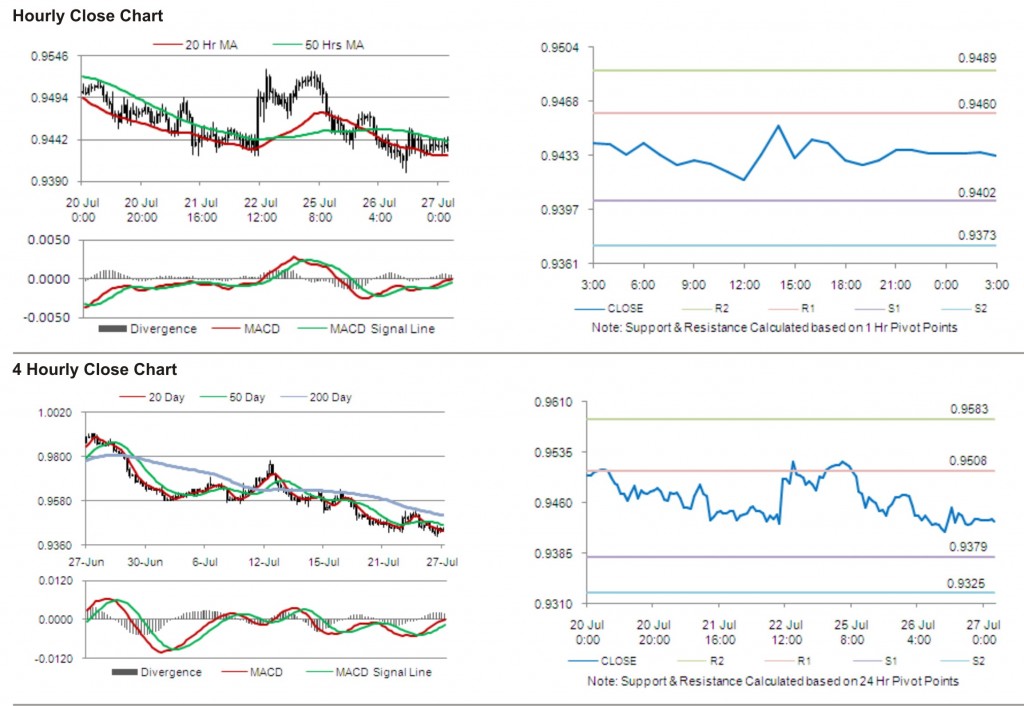

The first area of short term resistance is observed at 0.9460, followed by 0.9489 and 0.9547. The first area of support is at 0.9402, with the subsequent supports at 0.9373 and 0.9315.

Trading trends in the pair today are expected to be determined by release of national bank HP index in Canada.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.