For the 24 hours to 23:00 GMT, GBP fell 0.55% against the USD and closed at 1.6329, after the report showed that UK factory orders declined more than expected and manufacturers’ optimism plunged to the lowest in two years.

The Confederation of British Industry (CBI) reported that 19.0% of manufacturers in the UK indicated that the total order books were above normal, while 29.0% of the manufacturers indicated that the order books were below normal. The order book balance fell to -10.0 in July, following a balance of 1.0 recorded in the previous month. Meanwhile, the production expectations balance decline to 6.0 in July, compared to a balance of 13.0 recorded in June.

The pair opened the Asian session at 1.6329, and is trading at 1.6328 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

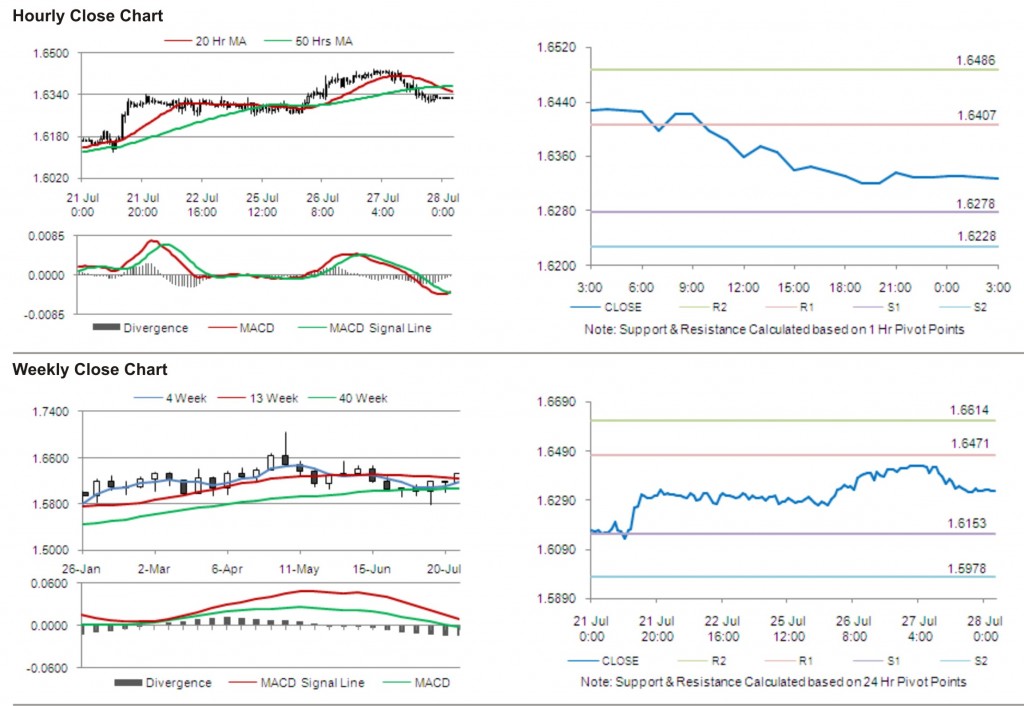

The pair has its first short term resistance at 1.6407, followed by the next resistance at 1.6486. The first support is at 1.6278, with the subsequent support at 1.6228.

Trading trends in the pair today are expected to be determined by data release on consumer confidence in the UK.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.