For the 24 hours to 23:00 GMT, EUR declined 0.95% against the USD and closed at 1.4367.

Standard & Poor’s on Wednesday downgraded Greece’s sovereign credit rating further into junk territory, lowering it to ‘CC’ from ‘CCC’, stating that the European Union’s proposed debt restructuring would put the country into “selective default”.

In the economic news, the M3 money supply, on annual basis, in the Euro zone declined to 2.1%, compared to an upwardly revised rate of 2.5% recorded in the previous month. Additionally, in Germany, the consumer price index rose 0.4% (M-o-M) in July, following a 0.1% increase in June. The import price index declined 0.6% (M-o-M) in June, following a similar drop recorded in May.

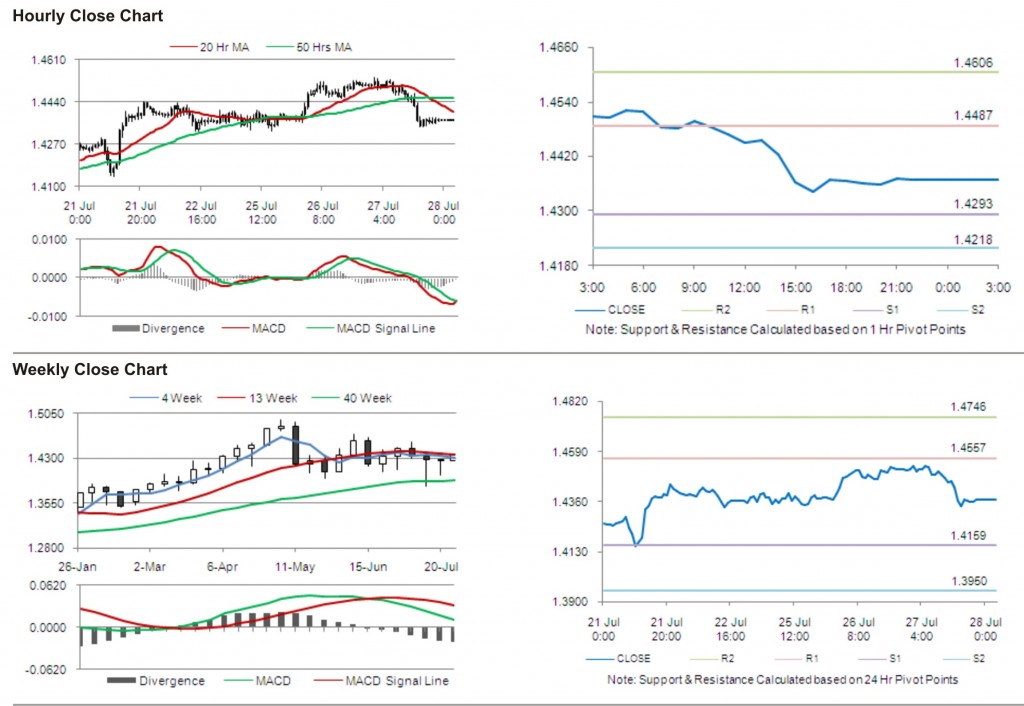

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4368, flat from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4487, followed by the next resistance at 1.4606. The first support is at 1.4293, with the subsequent support at 1.4218.

With a series of Euro zone economic releases today, including economic confidence and industrial confidence, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.