For the 24 hours to 23:00 GMT, USD weakened 0.17% against the JPY and closed at 77.79.

In Japan, this morning, the industrial production rose 3.9% (M-o-M) in June following a 6.2% rise in May. The unemployment rate came in at a seasonally adjusted 4.6% in June compared to 4.5% in the previous month. The manufacturing Purchasing Managers’ Index (PMI) in Japan rose to a seasonally adjusted reading of 52.1 in July, the highest level since February 2011, and compared to a reading of 50.7 recorded in the previous month.

Additionally, the consumer price index came in at 0.2% (Y-o-Y) in June from 0.3% in the previous month.

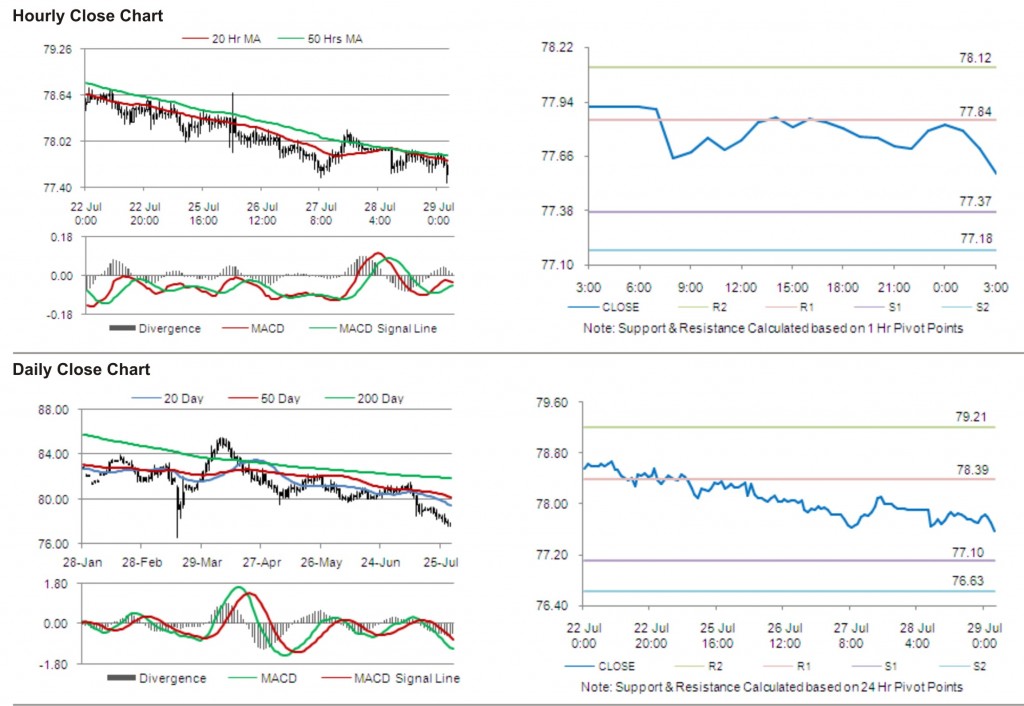

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.28%, at 77.57.

The first short term resistance is at 77.84, followed by 78.12. The pair is expected to find support at 77.37 and the subsequent support level at 77.18.

Trading trends in the pair today are expected to be determined by data release on housing starts and construction orders in Japan.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.