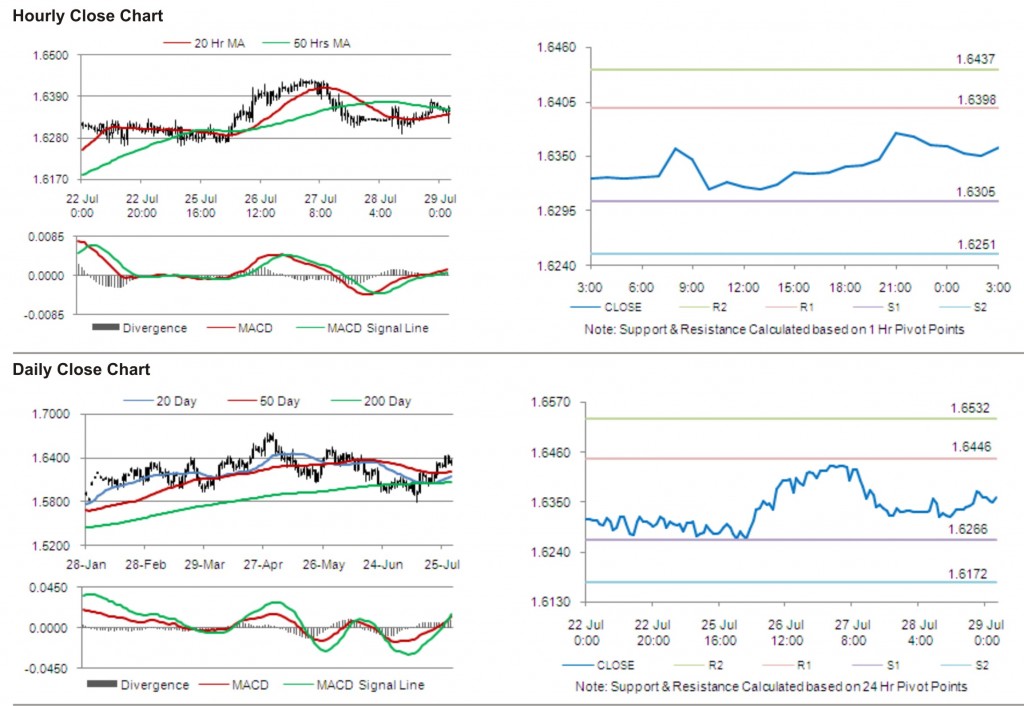

For the 24 hours to 23:00 GMT, GBP rose 0.20% against the USD and closed at 1.6361.

In the UK, the consumer confidence declined to -30.0 in July from -25.0 in the previous month. Additionally, the Confederation of British Industry (CBI) in its distributive trade survey indicated that 33.0% of retailers in the UK witnessed an annual rise in sales volumes in July, while 38.0% of retailers reported a fall in sales volumes. The resulting balance of -5.0% in July was the weakest since June 2010, and compared to a balance of -2.0% recorded in the previous month.

The pair opened the Asian session at 1.6361, and is trading at 1.6359 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6398, followed by the next resistance at 1.6437. The first support is at 1.6305, with the subsequent support at 1.6251.

With a series of UK economic releases today, including money supply and consumer credit, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.