For the 24 hours to 23:00 GMT, AUD weakened 0.29% against the USD to close at 1.0999, as investors waited to see whether US lawmakers would be able to agree on a plan to raise the country’s borrowing limit and avoid a catastrophic default.

In the US, the initial jobless claims fell to 398,000, compared to the previous week’s revised figure of 422,000. Additionally, for the week ended 16 July 2011, continuing claims fell to 3.703 million, compared to the preceding week’s revised level of 3.720 million.

In Australia, this morning, the private sector credit declined 0.1% (M-o-M) in June, following a 0.3% rise in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 1.0981, 0.16% lower from yesterday’s close at 23:00 GMT.

LME Copper prices rose 0.1% or $8.3/MT to $9,743.8/ MT. Aluminium prices declined 0.8% or $21.8/MT to $2,600.5/ MT.

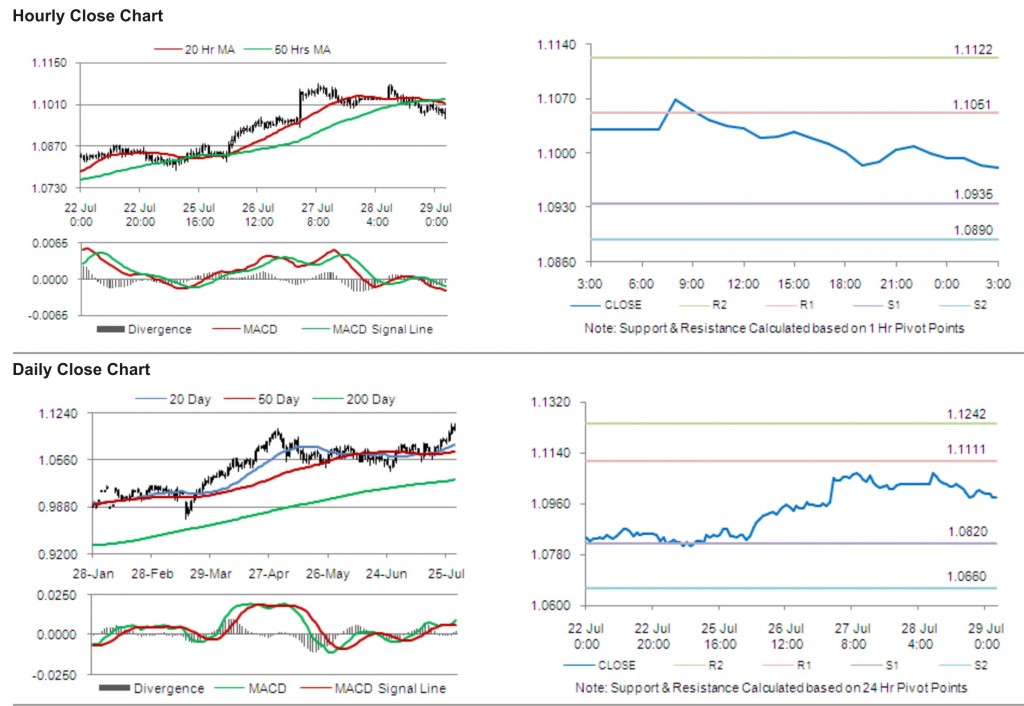

The pair is expected to find first short term resistance at 1.1051, with the next resistance levels at 1.1122 and 1.1238, subsequently. The first support for the pair is seen at 1.0935, followed by next supports at 1.0890 and 1.0774 respectively.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.