For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.1292.

On the data front, the Euro-zone’s preliminary consumer confidence index unexpectedly declined to a level of -7.2 in June, compared to market expectations for an unchanged reading. In the prior month, the index had registered a level of -6.5.

The European Central Bank, in its economic bulletin, highlighted a cautious outlook and indicated that underlying growth momentum within the Eurozone has continued to soften since the start of the year. Further, the ECB maintained its dovish stance and loosening monetary policy before the end of the year. Additionally, the central bank projected global growth to decelerate this year.

In the US, data showed that the Philadelphia Fed manufacturing index fell to a 4-month low level of 0.3 in June, compared to a level of 16.6 in the previous month. Market participants had anticipated the index to fall to a level of 10.4. Meanwhile, the nation’s seasonally adjusted initial jobless claims dropped to a level of 216.0K in the week ended 15 June 2019, more than market expectations for a drop to a level of 220.0K. Initial jobless claims had recorded a reading of 222.0K in the previous week. Separately, the US leading indicator remained flat on a monthly basis in May, defying market consensus for a rise of 0.1%. In the previous month, leading indicator had recorded a revised rise of 0.1%.

In the Asian session, at GMT0300, the pair is trading at 1.1303, with the EUR trading 0.10% higher against the USD from yesterday’s close.

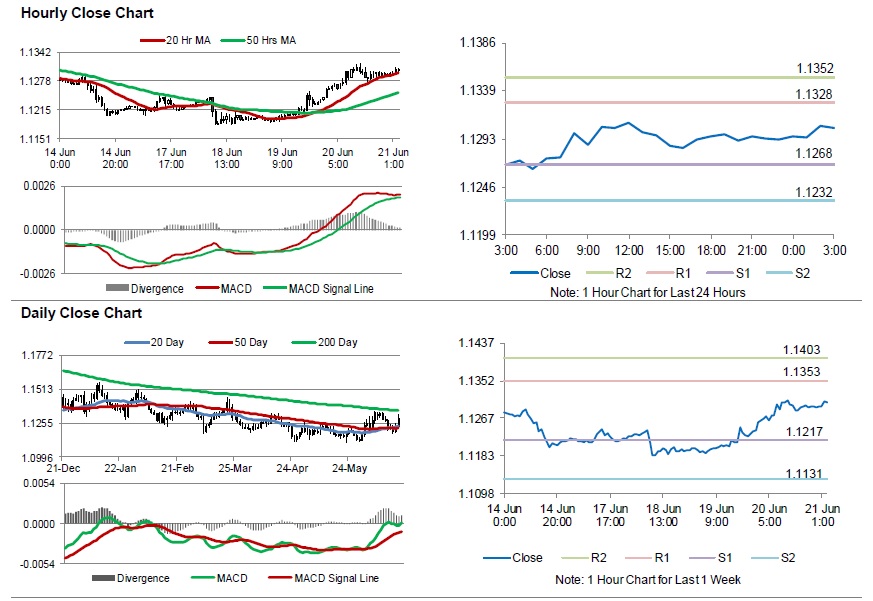

The pair is expected to find support at 1.1268, and a fall through could take it to the next support level of 1.1232. The pair is expected to find its first resistance at 1.1328, and a rise through could take it to the next resistance level of 1.1352.

Looking ahead, traders would closely monitor the Markit manufacturing and services PMIs for June, slated to release across the euro bloc. Later in the day, the US Markit manufacturing and services PMI for June followed by existing home sales for May, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.