For the 24 hours to 23:00 GMT, the GBP rose 0.42% against the USD and closed at 1.2705.

The Bank of England (BoE), in its latest policy meeting, kept its key interest rate unchanged at 0.75%, as widely expected and slashed its growth forecast to 0% for the second half 2019, amid uncertainties surrounding Brexit.

In economic news, UK’s retail sales slid 0.5% on a yearly basis in May, compared to a revised fall of 0.1% in the previous month. Market participants had anticipated the retail sales to register a decline of 0.5%.

In the Asian session, at GMT0300, the pair is trading at 1.2716, with the GBP trading 0.09% higher against the USD from yesterday’s close.

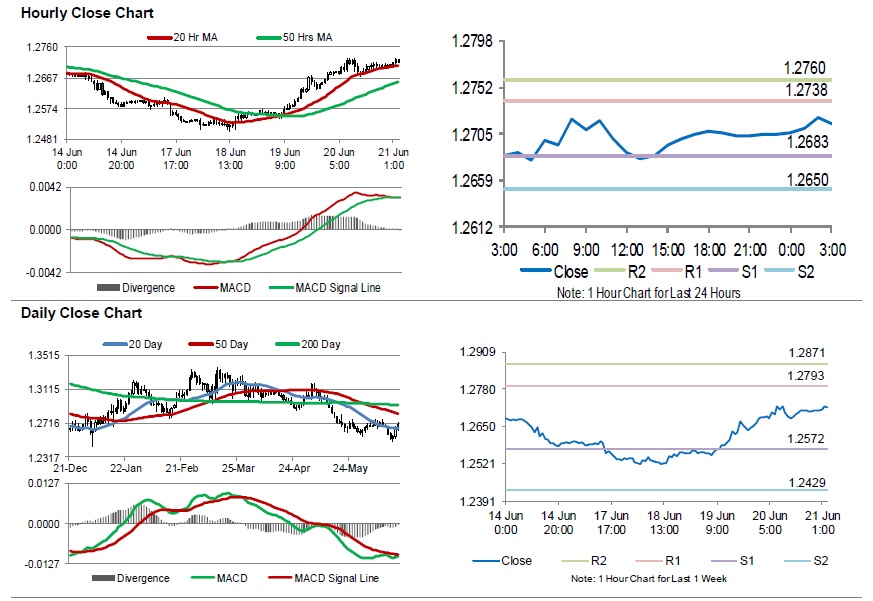

The pair is expected to find support at 1.2683, and a fall through could take it to the next support level of 1.2650. The pair is expected to find its first resistance at 1.2738, and a rise through could take it to the next resistance level of 1.2760.

Trading trend in the Sterling today, is expected to be determined by UK’s public sector net borrowing for May, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.