For the 24 hours to 23:00 GMT, EUR declined 0.61% against the USD and closed at 1.4172, on speculation that the European Central Bank would signal an interest-rate hike at its meeting tomorrow.

Further, the Euro was also pressurized by a strong dollar, following the Senate approval of the US debt bill.

Early Tuesday, President Barack Obama signed a debt-limit compromise that prevents a US default.

Moody’s Investors Service and Fitch Ratings affirmed their AAA credit ratings for the US while warned that the ratings could be downgraded if lawmakers fail to enact debt reduction measures and the economy weakens.

In the economic news, the producer price index, on monthly basis, in the Euro-zone remained flat in June, compared to a 0.2% drop recorded in the previous month.

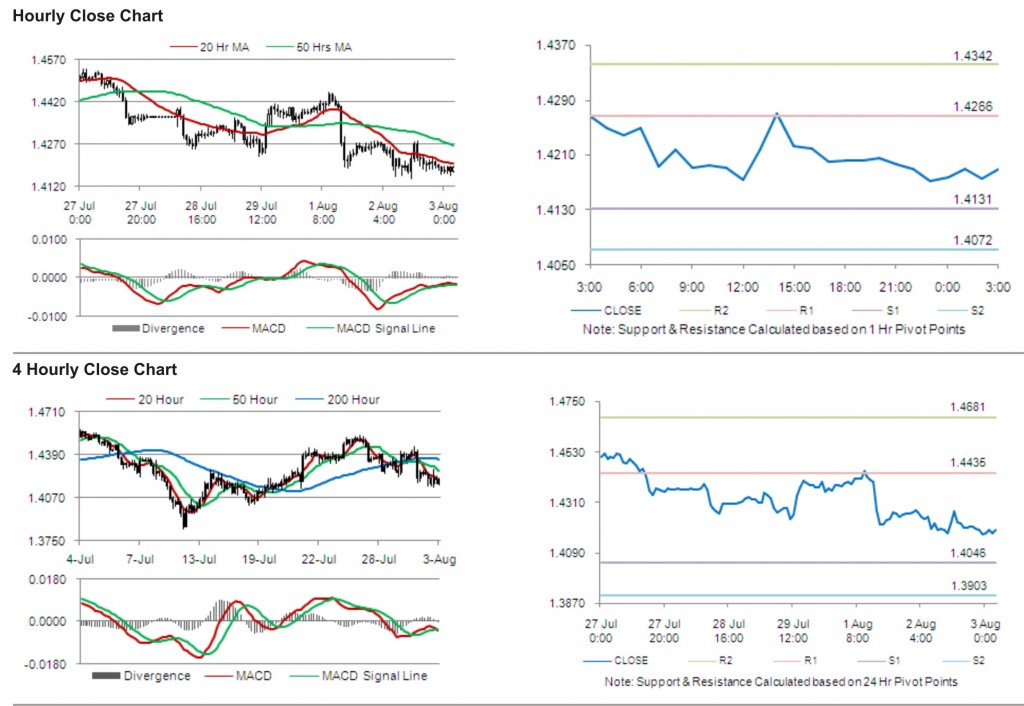

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4190, 0.13% higher from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4266, followed by the next resistance at 1.4342. The first support is at 1.4131, with the subsequent support at 1.4072.

Trading trends in the pair today are expected to be determined by release of services purchasing managers index and retail sales in the Euro zone.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.