For the 24 hours to 23:00 GMT, GBP fell 0.14% against the USD and closed at 1.6275, amid poor UK construction data.

In the UK, construction Purchasing Managers’ Index (PMI) declined to a reading of 53.5 in July, following a reading of 53.6 recorded in June.

The International Monetary Fund (IMF) has warned that the UK’s economy has less capacity to grow quickly over the next few years then the government had hoped and that policy changes may be needed if conditions deteriorate further.

This morning, the BRC Shop Price Index, on monthly basis, declined to 2.8% in July from 2.9% recorded in the previous month.

The pair opened the Asian session at 1.6275, and is trading at 1.6272 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

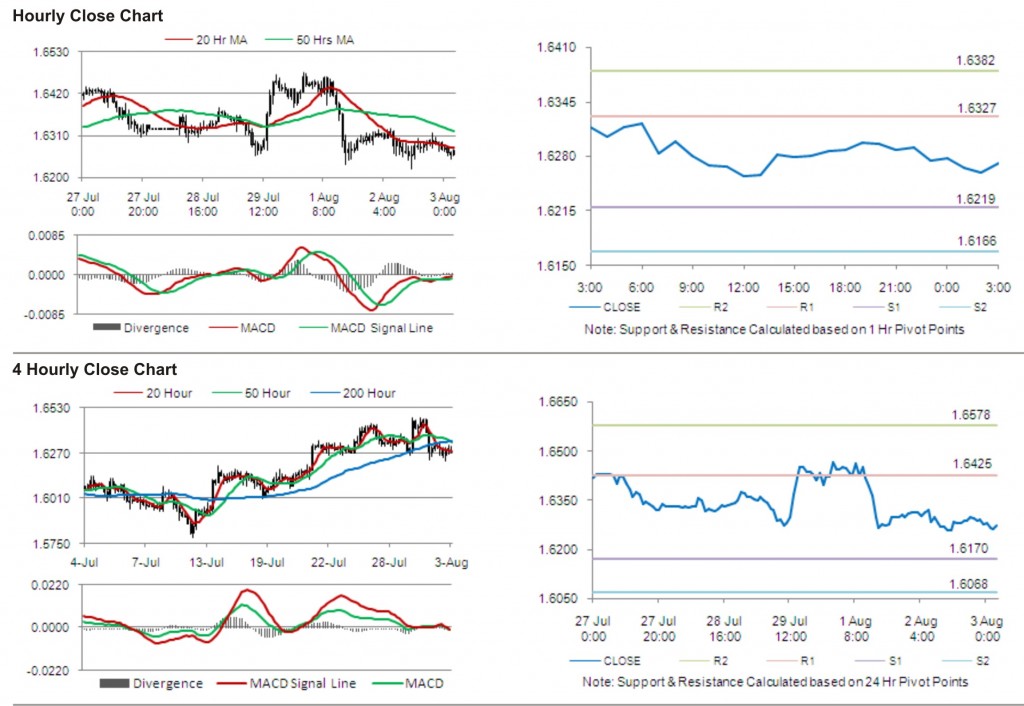

The pair has its first short term resistance at 1.6327, followed by the next resistance at 1.6382. The first support is at 1.6219, with the subsequent support at 1.6166.

Trading trends in the pair today are expected to be determined by release of services purchasing managers index in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.