For the 24 hours to 23:00 GMT, EUR rose 1.28% against the USD and closed at 1.4353.

The greenback fell versus the Euro, on speculation the Federal Reserve would consider increasing monetary stimulus to counter a slowdown in the US economy.

In the Euro zone, the composite Purchasing Managers’ Index (PMI) was revised upwards to a reading of 51.1 in July, compared to an initial estimate of 50.8. On a monthly basis, retail sales rose 0.9% in June, following a 1.3% decline recorded in May.

Meanwhile, in the German economic news, on a seasonally adjusted basis, the services Purchasing Managers’ Index (PMI) stood at a reading of 52.9 in July, in-line with the initial estimate.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4303, 0.35% lower from the levels yesterday at 23:00GMT.

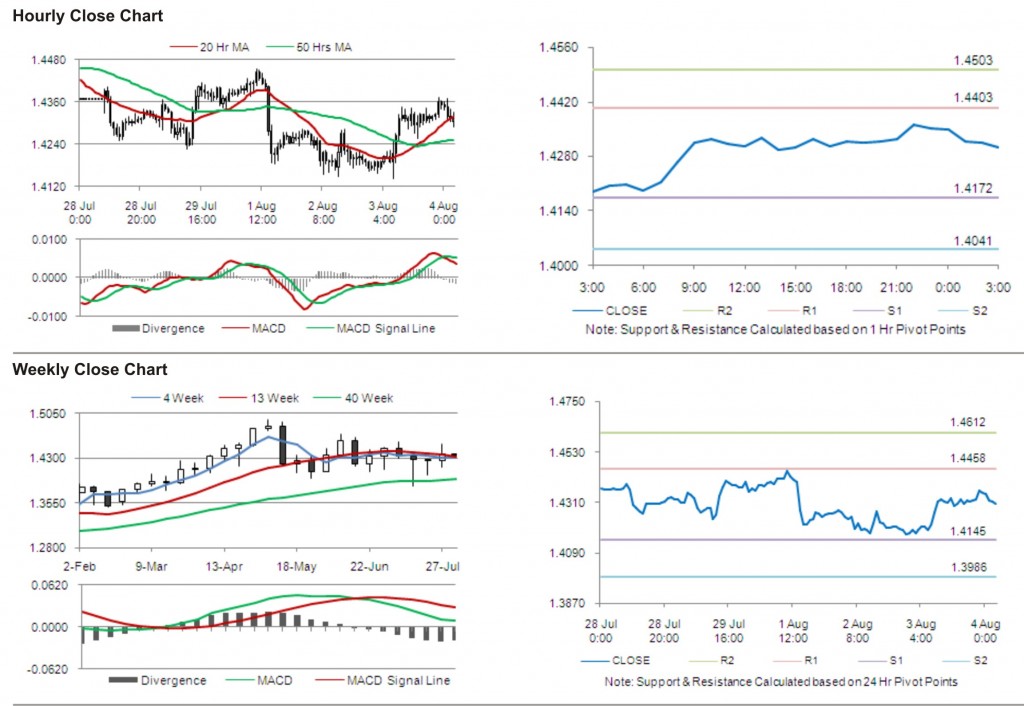

The pair has its first short term resistance at 1.4403, followed by the next resistance at 1.4503. The first support is at 1.4172, with the subsequent support at 1.4041.

ECB Interest Rate Decision is likely to receive increased market attention today.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.