For the 24 hours to 23:00 GMT, USD declined 1.17% against the CAD to close at 0.9802, after the US Federal Reserve indicated that it would maintain its hefty monetary policy stimulus for another two years.

In Canada, the Canada Mortgage and Housing Corporation reported that the seasonally adjusted annual rate of housing starts advanced to 205,100 units in July, compared to a revised annual rate of 196,600 units recorded in June.

In the Asian session at 3:00GMT, the pair is trading at 0.9811, 0.09% higher from yesterday’s close at 23:00 GMT.

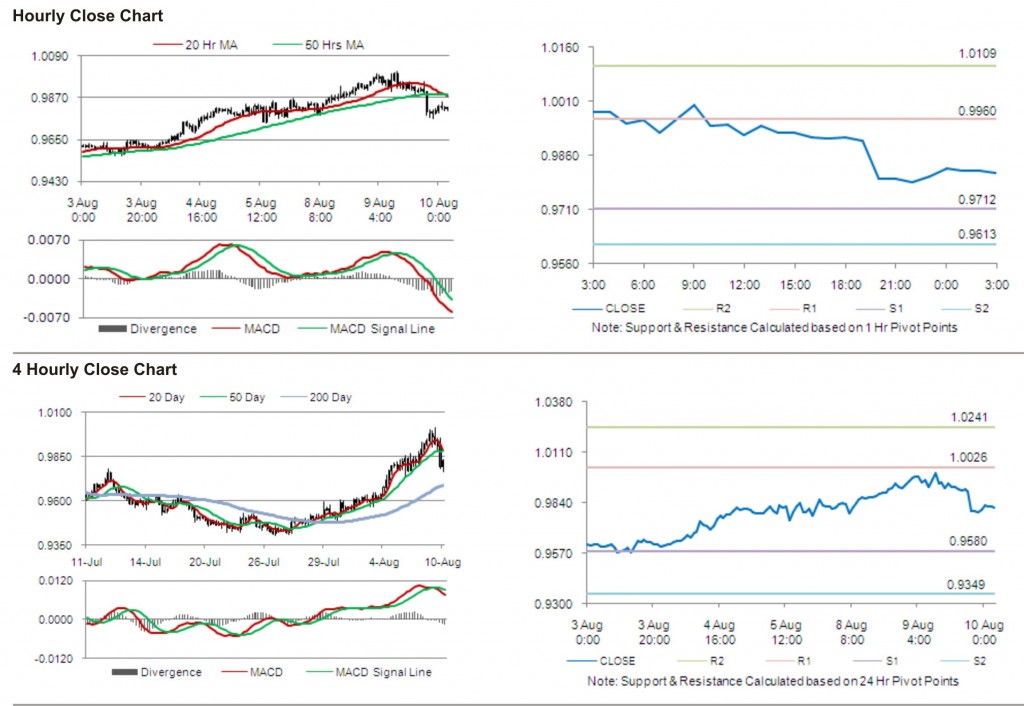

The first area of short term resistance is observed at 0.9960, followed by 1.0109 and 1.0357. The first area of support is at 0.9712, with the subsequent supports at 0.9613 and 0.9365.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.