For the 24 hours to 23:00 GMT, USD weakened 0.67% against the JPY and closed at 77.03, after the Federal Reserve stated that it would keep interest rates low for at least two years, keeping the Fed fund rate at 0.25% into 2013.

Moody’s Investors Service stated on Monday the impact of Japan’s currency market intervention last Thursday to weaken the yen was limited, so the recovery of the export-led Japanese economy from the March earthquake remains threatened by a strong yen. It further stated that, while the government and the Bank of Japan took coordinated steps to push the yen lower, the effects of the intervention “were partially reversed the next day, a credit negative for Japan’s fragile recovery.”

In Japan, the consumer sentiment index climbed to 37.0 in July, in line with market estimates, compared to 35.3 in June. Also the Japan Machine Tool Builders’ Association indicated that on an annual basis, the machine tool orders edged up 34.6% in July, following a 53.5% rise in June.

This morning, in Japan, the Domestic Corporate Goods Price Index (DCGPI) rose 0.2% (M-o-M) to 105.7 in July, compared to a 0.1% (M-o-M) rise in June. Additionally, on a seasonally adjusted monthly basis, the tertiary industry activity index edged up 1.9% to 98.5 in June.

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.26%, at 76.83.

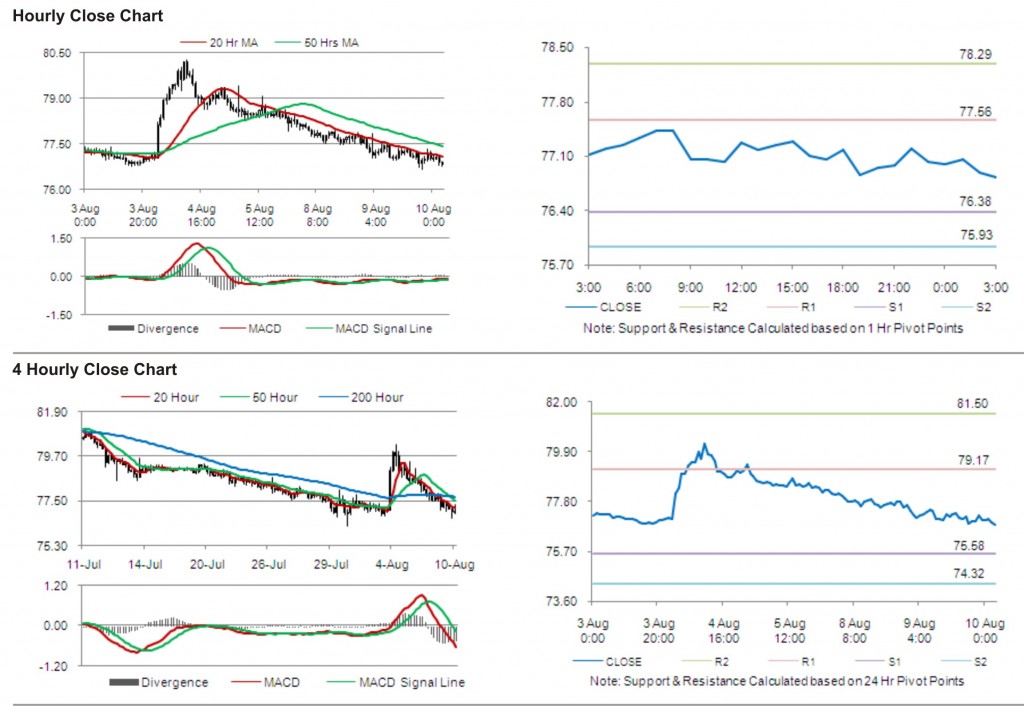

The first short term resistance is at 77.56, followed by 78.29. The pair is expected to find support at 76.38 and the subsequent support level at 75.93.

Trading trends in the pair today are expected to be determined by data release on core machinery orders in Japan.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.