For the 24 hours to 23:00 GMT, USD declined 0.67% against the CHF and closed at 0.7895, after the Swiss National Bank’s latest steps to curb Franc strength fell short of expectations.

The Swiss National Bank (SNB) in a statement yesterday stated that it would boost liquidity to the money market, expanding banks’ sight deposits to CHF200 billion from CHF120 billion, but did not mention any plans to peg the currency to the euro. The bank would also continue to buy SNB bills and use foreign-exchange swap transactions.

Switzerland Finance Minister, Eveline Widmer-Schlumpf stated that the government would support any measure by the SNB to curb the currency’s advance.

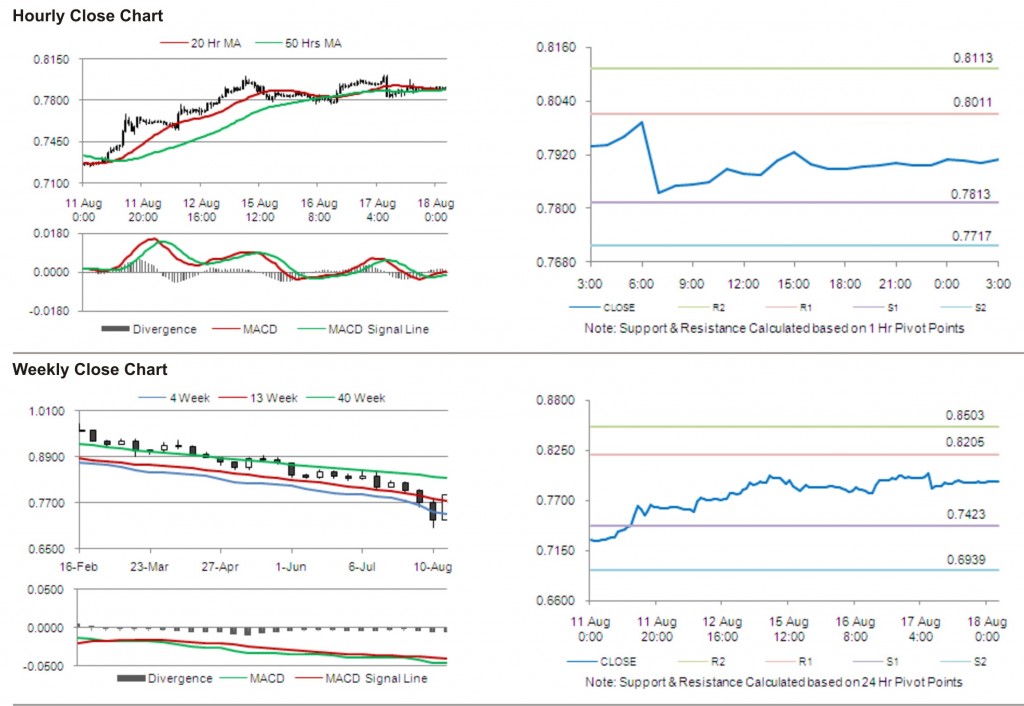

In the Asian session, at 3:00GMT, the pair is trading at 0.7908, 0.16% higher from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 0.8011, followed by the next resistance at 0.8113. The first area of support is at 0.7813 level, with the subsequent support at 0.7717.

With no major release from Switzerland, the pair is expected to trade on trends in the greenback.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.