For the 24 hours to 23:00 GMT, USD declined 0.27% against the CAD to close at 0.9801, amid rise in oil prices.

In the US, on a monthly basis, the producer price index rose 0.2% in July, following a 0.4% decrease recorded in June.

In Canada, the foreign investors divested C$4.5 billion in Canadian bonds in June, compared to C$11.1 billion invested in Canadian bonds in May. Meanwhile, Canadian investors reduced their holdings of foreign bonds by C$3.2 billion in June.

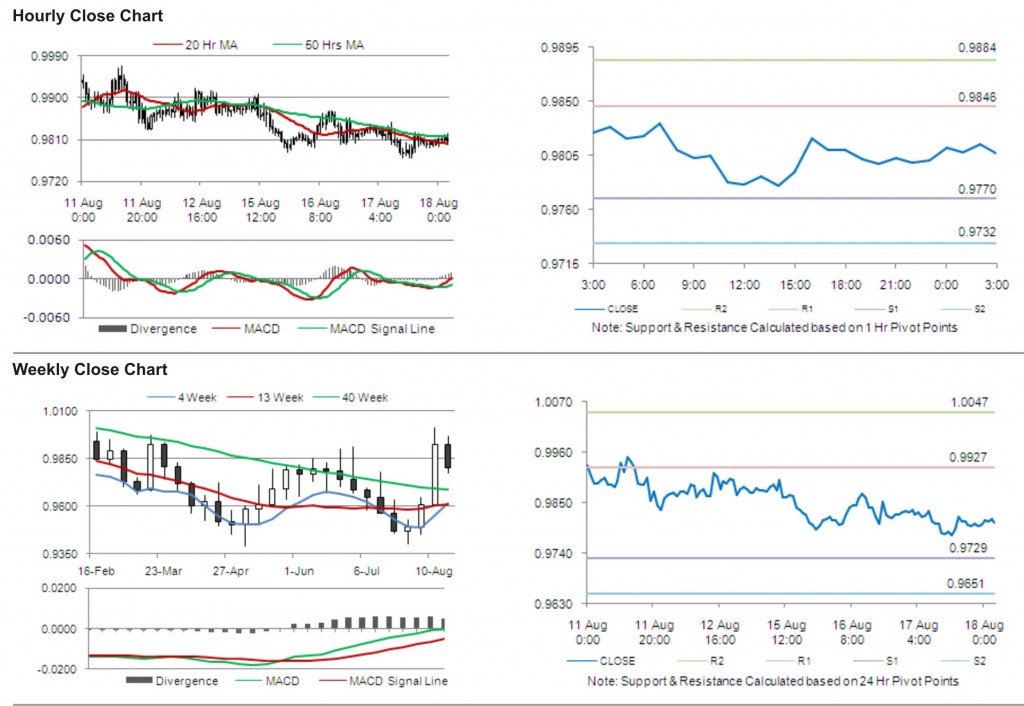

In the Asian session at 3:00GMT, the pair is trading at 0.9807, marginally higher from yesterday’s close at 23:00 GMT.

The first area of short term resistance is observed at 0.9846, followed by 0.9884 and 0.9960. The first area of support is at 0.9770, with the subsequent supports at 0.9732 and 0.9656.

Bank of Canada monetary policy report is likely to receive increased market attention, along with other Canadian economic data due to be released later today.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.