For the 24 hours to 23:00 GMT, USD strengthened 0.17% against the JPY and closed at 76.65, amid fears on intervention by Japanese authorities.

Yesterday, Japan’s Finance Minister, Yoshihiko Noda stated that he would continue to monitor the foreign exchange markets carefully and would take necessary action, if required, to halt the gains in yen. He hinted at another market intervention by the government as well as monetary easing by the Bank of Japan, if the continued surge in yen threatens to derail the economy’s recovery.

In Japan, yesterday, the coincident index was revised upwards to 108.8 in June, from 106.1 in the previous month. Additionally, the leading index stood at a reading of 103.2 in June, compared to a reading of 99.4 posted in the previous month.

Additionally, in the US, on a seasonally adjusted monthly basis, the Consumer Price Index rose 0.5% in July, compared to a 0.2% decline recorded in June.

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.20%, at 76.50.

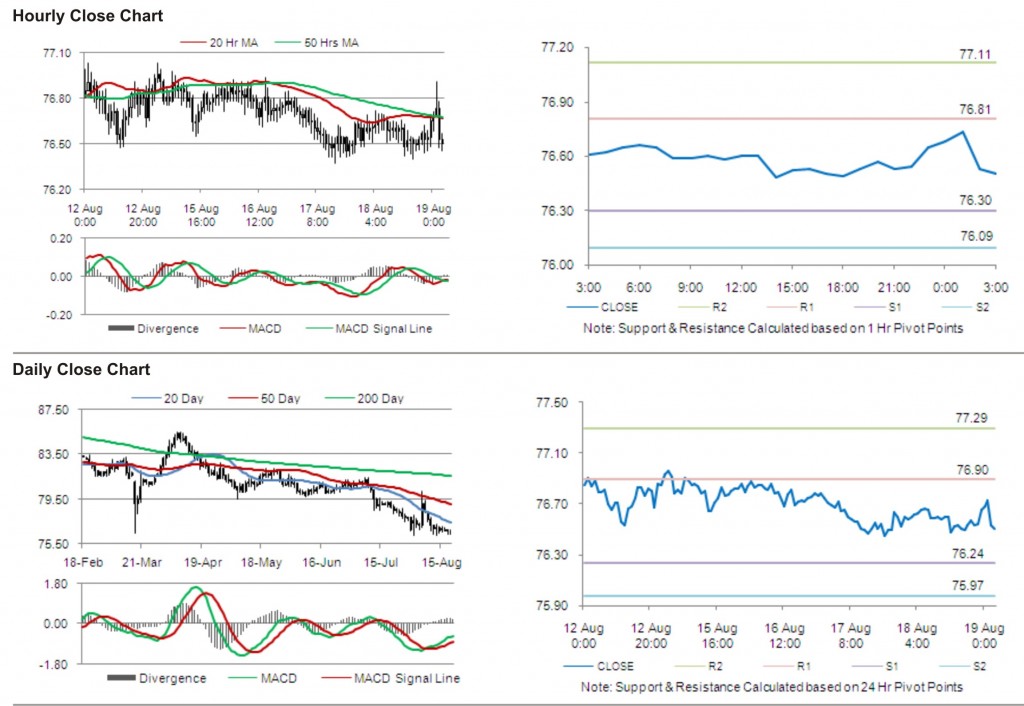

The first short term resistance is at 76.81, followed by 77.11. The pair is expected to find support at 76.30 and the subsequent support level at 76.09.

The pair is expected to trade on the cues from the release of All Industry Activity Index in Japan.

The currency pair is trading well below its 20 Hr and its 50 Hr moving averages.