For the 24 hours to 23:00 GMT, USD rose 1.10% against the CAD to close at 0.9909.

Canadian dollar declined against the greenback as lower commodity prices decreased the demand for the commodity linked currency.

In Canada, on a monthly basis, the wholesale sales rose by 0.2% to $47.8 billion in June, following an upwardly revised 2.0% increase recorded in May. Additionally, the leading index rose 0.2% (M-o-M) in July, following a 0.1% gain recorded in June.

In the US, on a seasonally adjusted monthly basis, the Consumer Price Index rose 0.5% in July, compared to a 0.2% decline recorded in June. Additionally, the Federal Reserve Bank of Philadelphia reported that its diffusion index of current activity fell to a reading of -30.7 in August, the lowest level since March 2009, and following a reading of 3.2 posted in July.

In the Asian session at 3:00GMT, the pair is trading at 0.9903, slightly lower from yesterday’s close at 23:00 GMT.

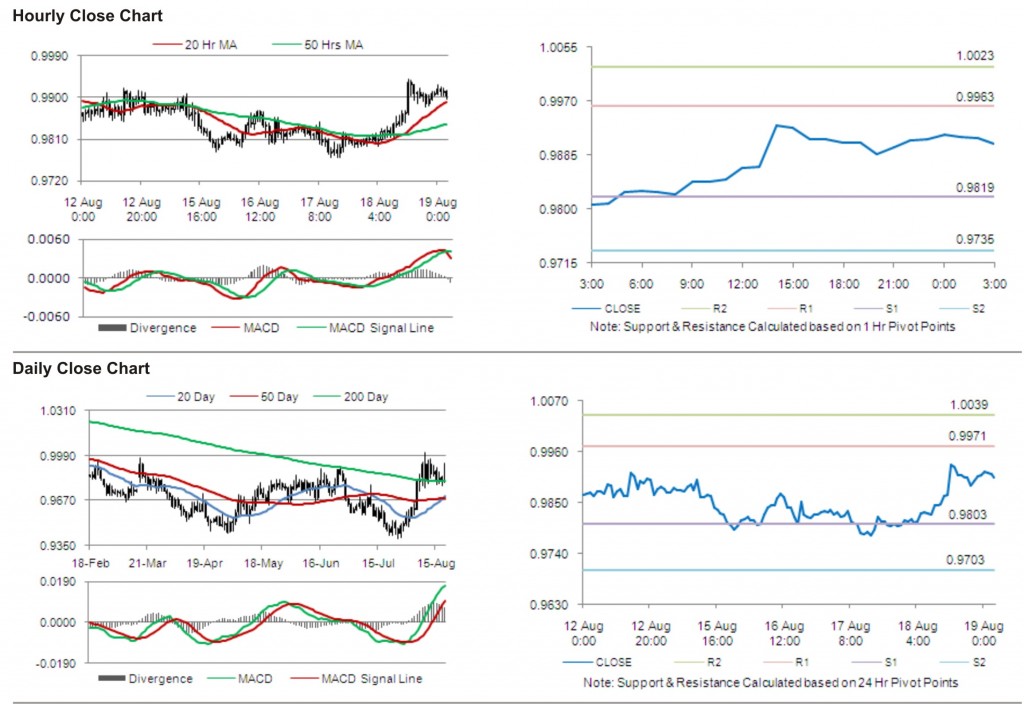

The first area of short term resistance is observed at 0.9963, followed by 1.0023 and 1.0167. The first area of support is at 0.9819, with the subsequent supports at 0.9735 and 0.9591.

The pair is expected to trade on the cues from the release of consumer price data in Canada.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.