For the 24 hours to 23:00 GMT, EUR declined 0.58% against the USD and closed at 1.4435, after a weak reading on consumer sentiment reinforced concerns that the region’s economy would slow in the months ahead as political leaders struggle with the debt crisis.

In the Euro zone, the economic confidence index fell unexpectedly to 98.3 in August, compared to 103.0 posted in July. Meanwhile, the consumer confidence index dipped to -16.5 in August, following a reading of -11.2 posted in the previous month.

Peripheral Euro zone debt concerns worsened as Finland proposed that Greece provide collateral in return for more aid. The Euro briefly pared losses against the dollar after the release of minutes from the Fed’s August meeting showed some members wanted substantial action to stoke the economy. The release of a report indicating confidence among the US consumers plunged in August to its lowest in two years kept investors risk averse.

In the Asian session, at 3:00GMT, the EUR is trading at 1.4431, marginally lower against USD, from the levels yesterday at 23:00GMT.

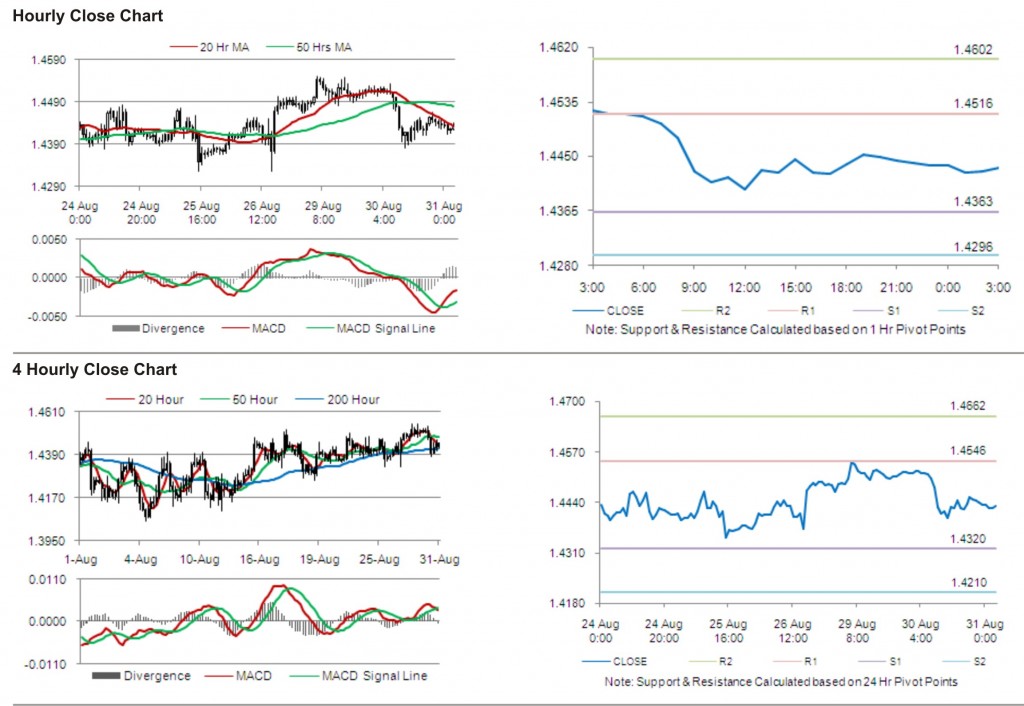

The pair has its first short term resistance at 1.4516, followed by the next resistance at 1.4602. The first support is at 1.4363, with the subsequent support at 1.4296.

With a series of Euro zone economic releases today, including Consumer Price Index (CPI) and unemployment rate, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.