For the 24 hours to 23:00 GMT, EUR declined 0.44% against the USD and closed at 1.4371.

German Chancellor Angela Merkel’s cabinet approved on Wednesday a modified plan of the euro zone rescue fund. European leaders agreed at the summit to strengthen the flexibility of the European Financial Stability Facility (EFSF), including purchasing government bonds in the secondary market and granting short-term loans to debt-ridden countries and commercial banks. The modified rescue package also asked Germany to raise its share of loan guarantees to €211 billion (304 billion U.S. dollars) from the original €123 billion, as the whole lending capacity of the EFSF was expanded from 250 billion to 440 billion euros.

On the economic front, Euro-zone’s annual consumer price inflation steadied at 2.5% in August, and the unemployment rate came in flat at 10.0% in July.

Meanwhile, Germany’s retail sales remained unchanged in July, compared to a revised 4.5% (MoM) rise in June. Moreover, the total unemployment fell by 8,000 in August, from a revised declined of 10,000 in July, also on a seasonally adjusted basis, the unemployment rate remained unchanged at 7.0% in August.

In the Asian session, at 3:00GMT, the EUR is trading at 1.4373, marginally higher against USD, from the levels yesterday at 23:00GMT, following worse than expected US labour data.

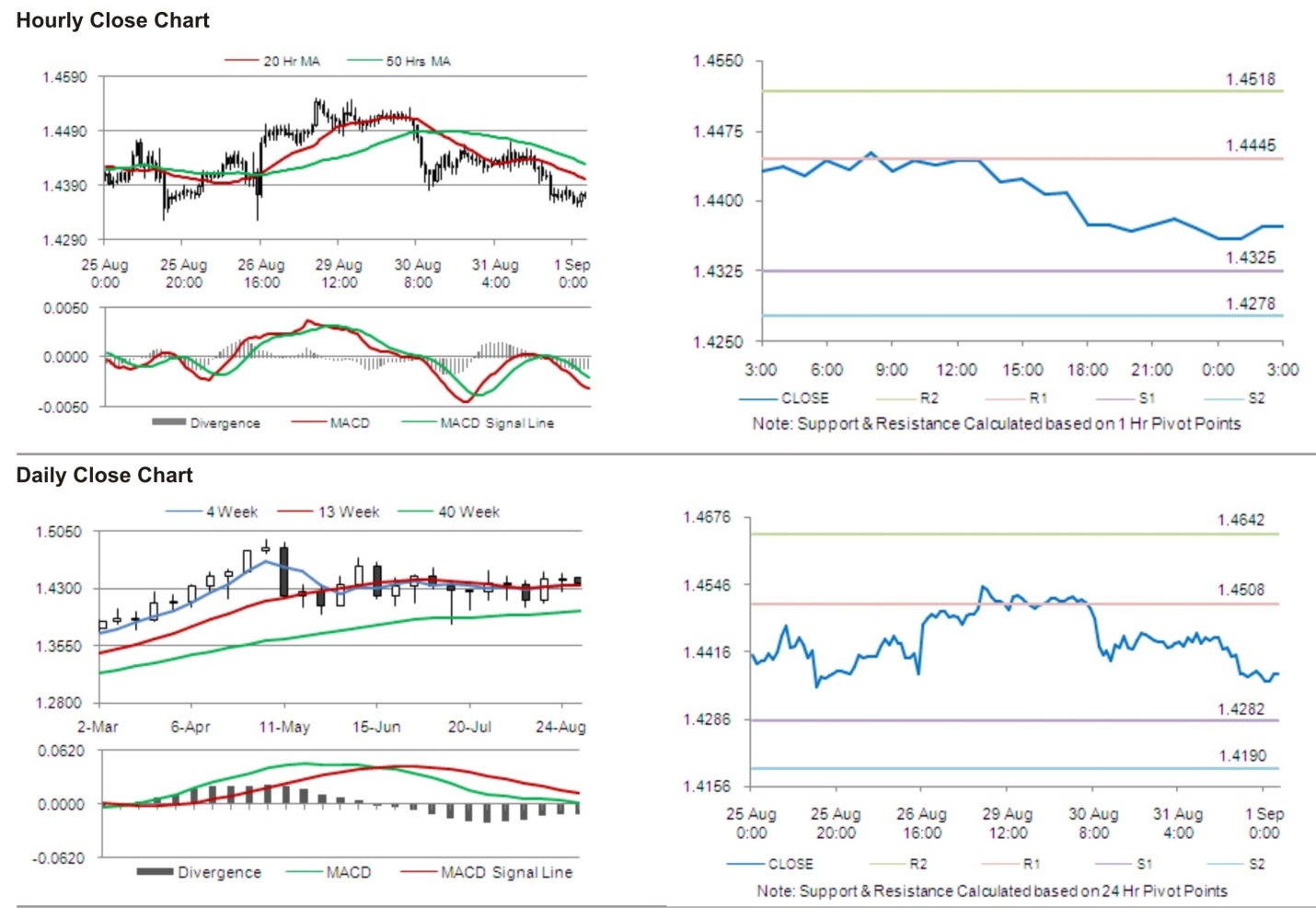

The pair has its first short term resistance at 1.4445, followed by the next resistance at 1.4518. The first support is at 1.4325, with the subsequent support at 1.4278.

Trading trends in the pair today are expected to be determined by release of manufacturing Purchasing Manager Index (PMI) in the Euro zone.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.