For the 24 hours to 23:00 GMT, GBP fell 0.37% against the USD and closed at 1.6244, as demand for the greenback was bolstered by robust US factory orders and better than expected Chicago-area business sentiment data.

In the US, new orders for manufactured goods edged up 2.4% (MoM) to $453.2 billion in July, compared to a revised 0.4% drop in June. Additionally, the Institute for Supply Management – Chicago reported that its business barometer fell to 56.5 in August, against the market expectation of a decline to 54.0 in August.

The pair opened the Asian session at 1.6244, and is trading at 1.6235 at 3.00GMT. GBP is trading 0.06% lower versus USD from yesterday’s close at 23:00 GMT.

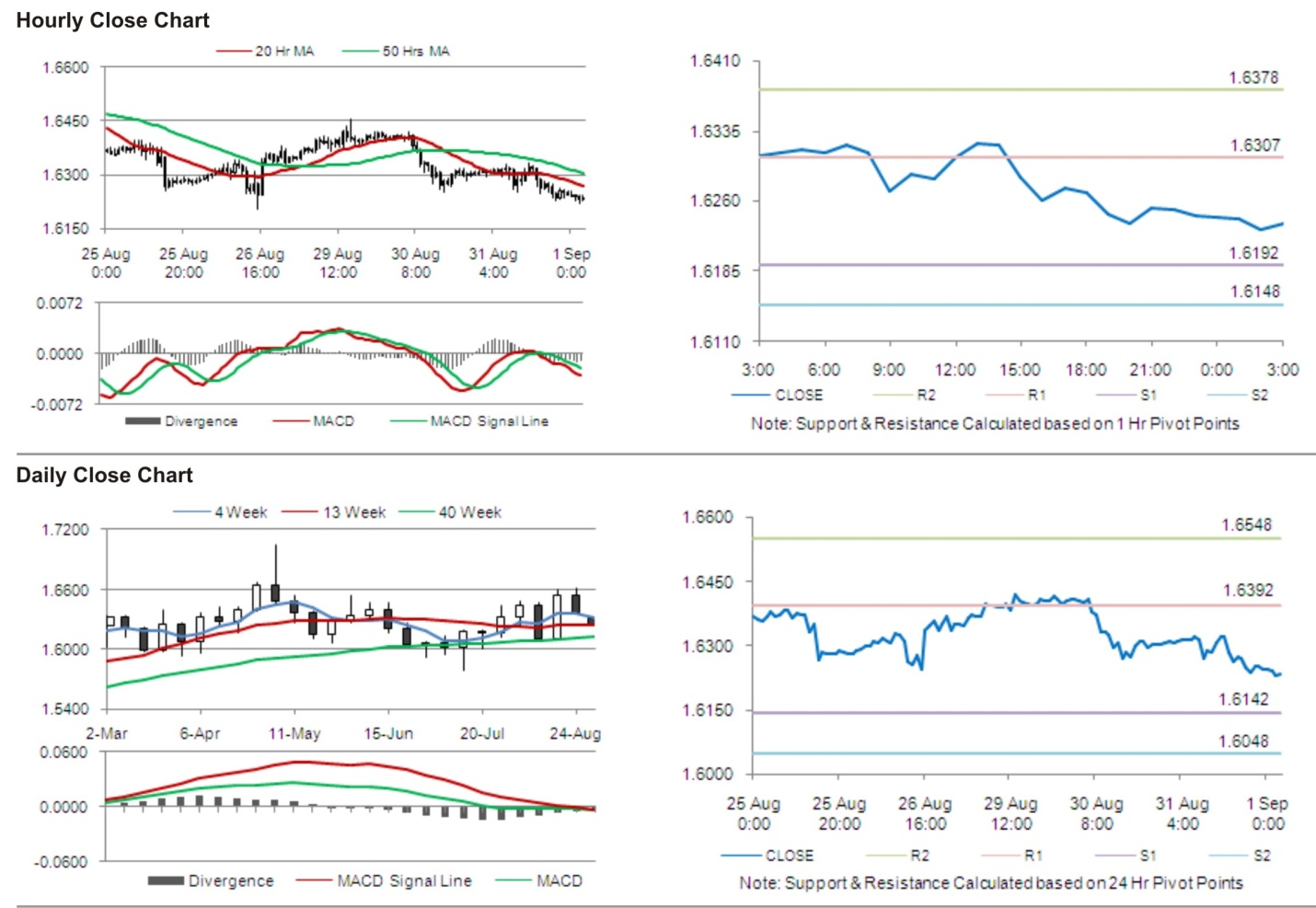

The pair has its first short term resistance at 1.6307, followed by the next resistance at 1.6378. The first support is at 1.6192, with the subsequent support at 1.6148.

Trading trends in the pair today are expected to be determined by release of manufacturing Purchasing Manager Index (PMI) and house price data in the UK.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.