For the 24 hours to 23:00 GMT, EUR declined 0.73% against the USD and closed at 1.4266, amid a slew of lacklustre manufacturing PMI data in Europe. Meanwhile, encouraging US economic data helped to boost the US dollar.

On the economic front, manufacturing Purchasing Managers’ Index (PMI) in the Euro-zone was revised to 49.0 in August, below the preliminary estimate of 49.7.

Additionally, in Germany, the Gross Domestic Product (GDP), on a sequential basis, edged up 0.1% in the second quarter of 2011 (2Q FY2011), while the German manufacturing PMI was revised lower to 50.9 in August, following a flash estimate of 52.0. Also, the manufacturing PMI in France was revised lower to 49.1 in August, compared to an initial estimate of 49.3.

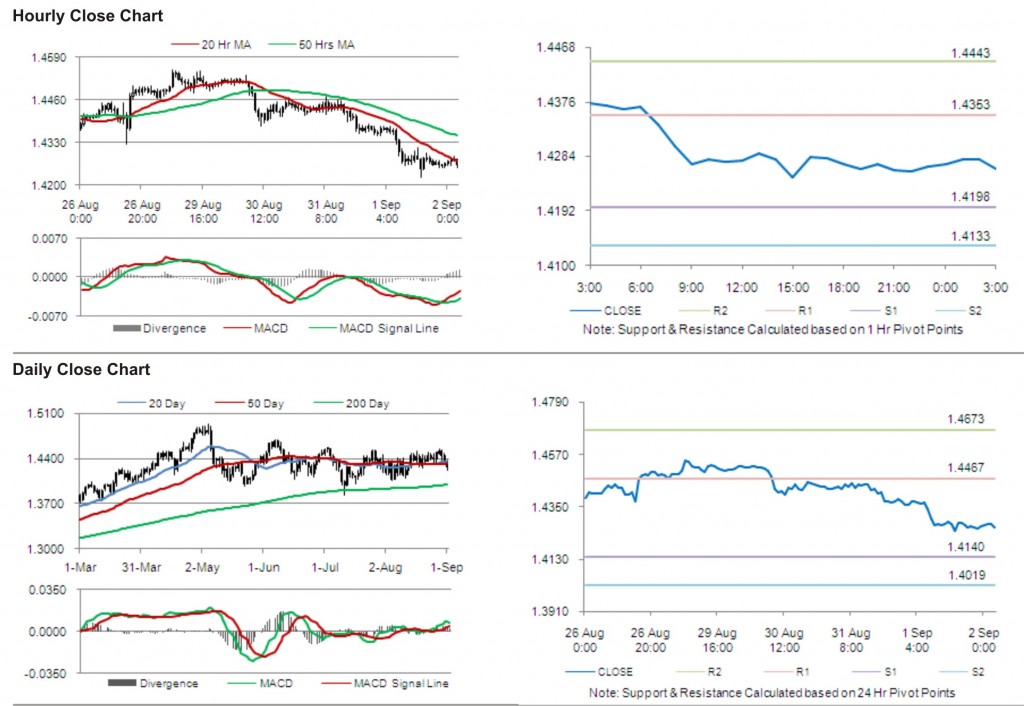

In the Asian session, at 3:00GMT, the EUR is trading at 1.4262, marginally lower against USD, from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4353, followed by the next resistance at 1.4443. The first support is at 1.4198, with the subsequent support at 1.4133.

Trading trends in the pair today are expected to be determined by release of Producer Price Index (PPI) in the Euro zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.