For the 24 hours to 23:00 GMT, GBP fell 0.38% against the USD and closed at 1.6183, amid poor UK manufacturing activity in August.

In the UK, the Markit/Chartered Institute of Purchasing & Supply (CIPS) manufacturing Purchasing Managers’ Index (PMI) dropped to 49.0 in August, compared to 49.4 in July. Moreover, the Nationwide Building Society indicated that, the house price index retreated 0.6% (M-o-M) in August, compared to a 0.3% (M-o-M) rise in July.

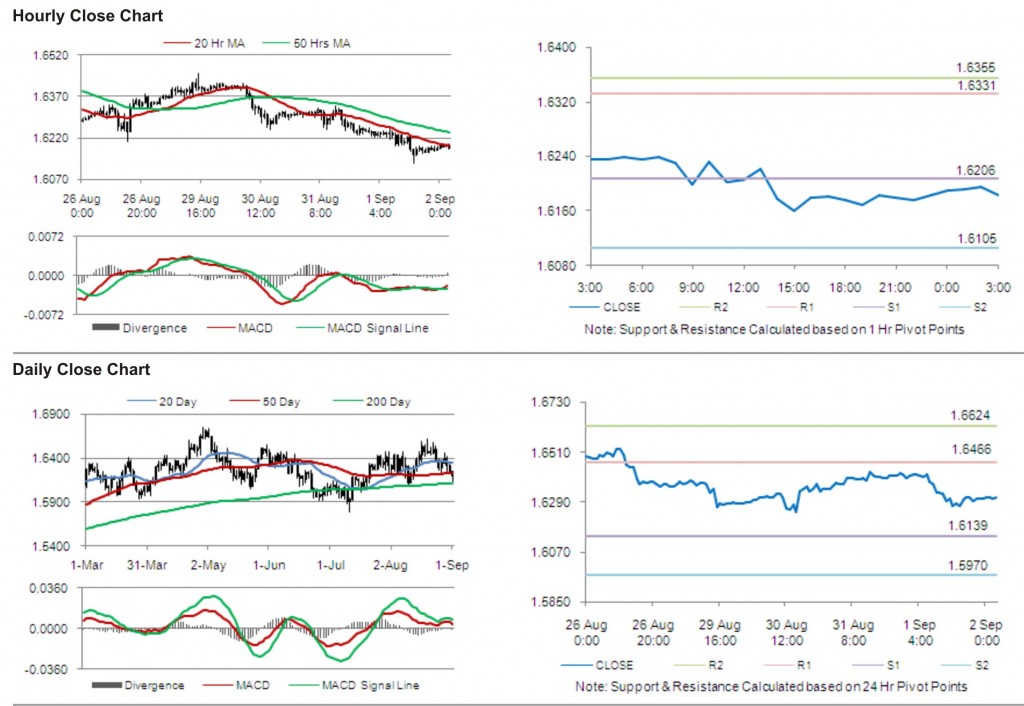

The pair opened the Asian session at 1.6183, and is trading at 1.6308 at 3.00GMT. GBP is trading marginally higher versus USD from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6331, followed by the next resistance at 1.6355. The first support is at 1.6206, with the subsequent support at 1.6105.

Trading trends in the pair today are expected to be determined by release of construction Purchasing Manager Index (PMI) in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.