For the 24 hours to 23:00 GMT, USD declined 1.45% against the CHF and closed at 0.7949. Swiss Franc rose against all its major counterparts, amid speculation the central bank would refrain from further measures to curb the currency’s advance.

In economic news, Switzerland’s Gross Domestic Product (GDP) on a sequential basis, climbed 0.4% in 2Q FY2011, compared to a revised 0.6% rise in 1Q FY2011. Moreover, the GDP grew 2.3% (Y-o-Y) in 2Q FY2011, from an upwardly revised 2.5% (Y-o-Y) surge in 1Q FY2011. Moreover, the SVME Association of Purchasing and Materials Management and Credit Suisse indicated that, the manufacturing PMI, on a seasonally adjusted basis, retreated to 51.7 in August, compared to 53.5 in July. Additionally, retail sales edged up 1.9% (Y-o-Y) in July, from an upwardly revised 7.9% surge in June.

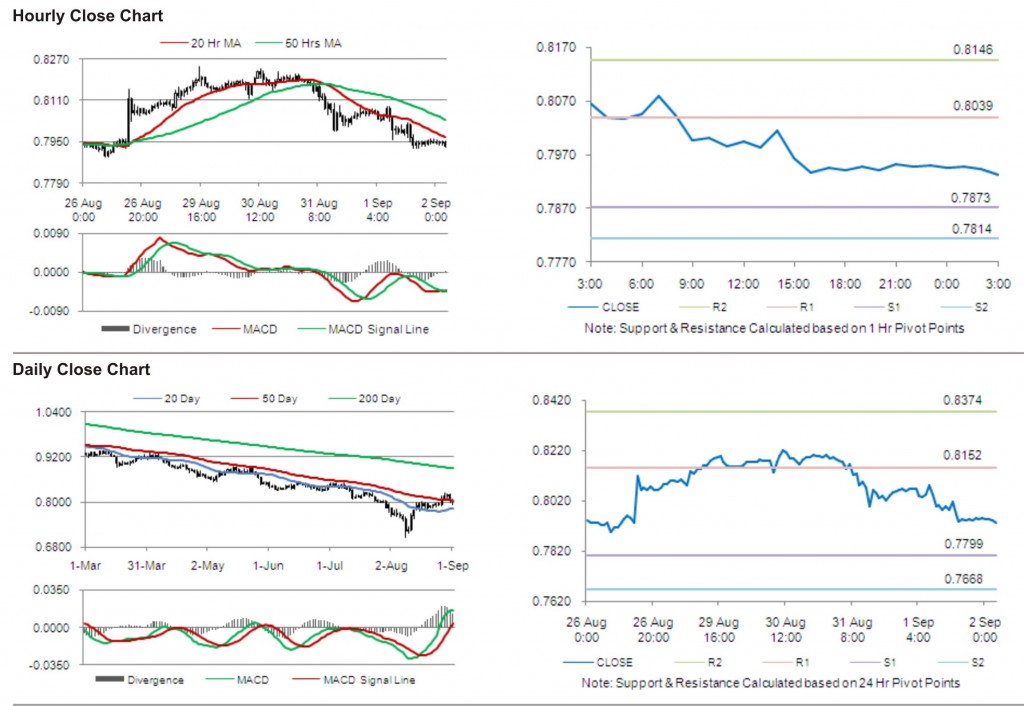

In the Asian session, at 3:00GMT, the USD is trading at 0.7931, 0.23% lower versus Swiss Franc, from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 0.8039, followed by the next resistance at 0.8146. The first area of support is at 0.7873 level, with the subsequent support at 0.7814.

The pair is expected to trade on the cues from the release of employment data in Switzerland.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.