For the 24 hours to 23:00 GMT, USD strengthened 0.12% against the JPY and closed at 76.84, as the greenback was buoyed by a positive Institute for Supply Management (ISM) manufacturing data.

In economic news, the Institute for Supply Management (ISM) revealed that its index of manufacturing activity in the US retreated to 50.6 in August, from 50.9 in July.

This morning, Japan’s capital spending edged down 7.8% (Y-o-Y) in 2Q FY2011, from a downwardly revised 3.0% (Y-o-Y) rise in the first quarter. Meanwhile, the Bank of Japan stated that its monetary base edged up 15.9% (Y-o-Y) in August from a rise of 15.0% (Y-o-Y) in July.

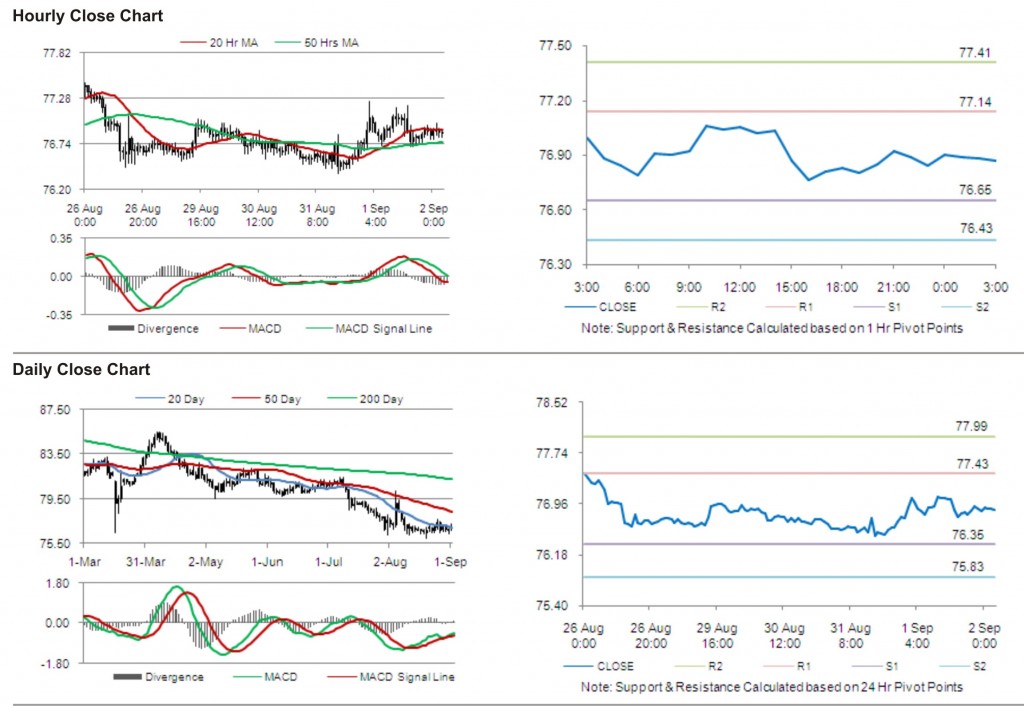

In the Asian session at 3:00GMT, the dollar is trading higher against yen from yesterday’s close at 23:00 GMT, by 0.04%, at 76.87.

The first short term resistance is at 77.14, followed by 77.41. The pair is expected to find support at 76.65 and the subsequent support level at 76.43.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.