For the 24 hours to 23:00 GMT, USD declined 0.58% against the CAD to close at 0.9840.

Canadian dollar advanced after the Richard Ivey School of Business reported that its Purchasing Managers Index (PMI) in Canada edged up by 12.2 points to 57.6 in August, against the market expectation of the Ivey PMI to rise to 46.8 in August.

Separately, the Bank of Canada left its key interest rate at 1.0%, in line with market estimates. Also, the central bank offered a pessimistic view of the global economy, hinting that interest rates would stay low for the next few months.

In the Asian session at 3:00GMT, USD is trading at 0.9854, 0.14% higher against the Canadian dollar from yesterday’s close at 23:00 GMT.

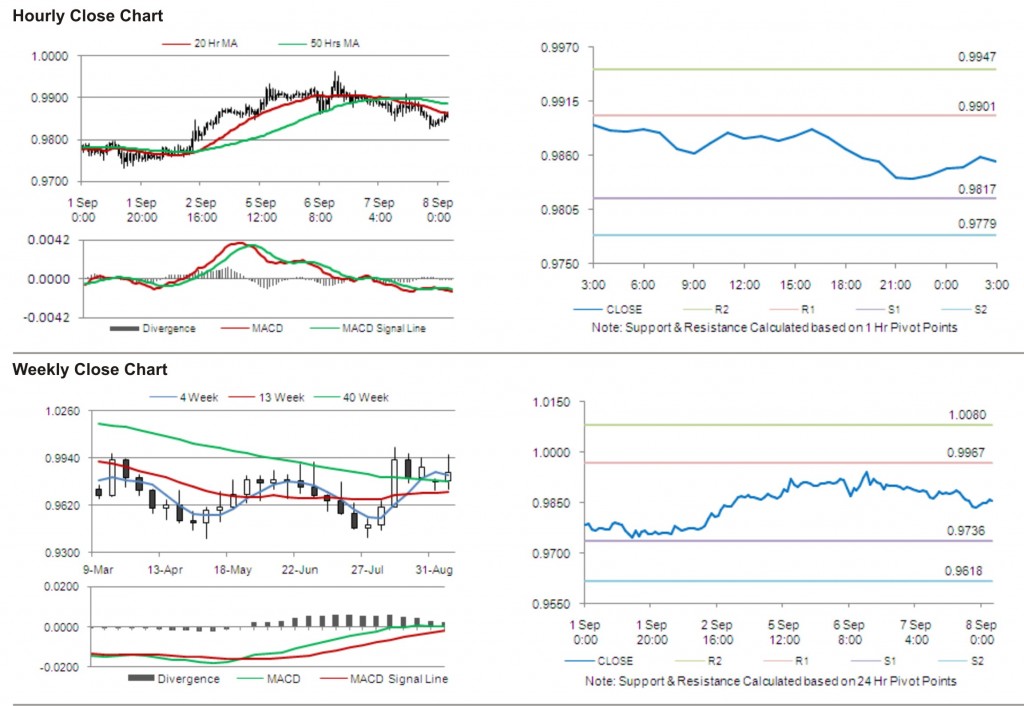

The first area of short term resistance is observed at 0.9901, followed by 0.9947 and 1.0031. The first area of support is at 0.9817, with the subsequent supports at 0.9779 and 0.9695.

The pair is expected to trade on the cues from the release of New Housing Price Index and trade data in Canada.

The currency pair is showing convergence with its 20 Hr moving average and is trading below 50 Hr moving average.