For the 24 hours to 23:00 GMT, USD weakened 0.37% against the JPY and closed at 77.32.

The Bank of Japan (BoJ) retained the uncollateralised overnight call rate at around 0.0%-0.1%. Additionally, the central bank left its credit and asset-purchasing programs unchanged at ¥50.0 trillion. Also, the leading index edged up to 106.0 in July, compared to 103.3 in June. Meanwhile, the coincident index fell to 109.0 in July, from 109.3 in June.

Additionally, the BoJ Governor, Masaaki Shirakawa, indicated that the central bank would closely monitor the impact of strong yen on business sentiment.

In the Asian session at 3:00GMT, the dollar is trading higher against yen from yesterday’s close at 23:00 GMT, by 0.05%, at 77.36.

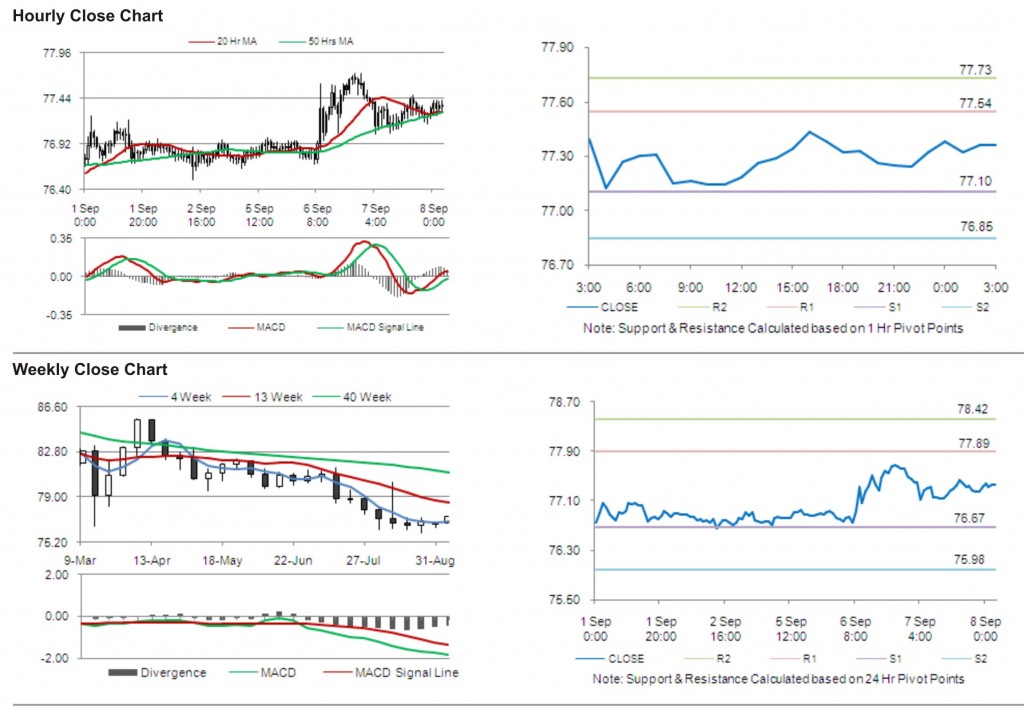

The first short term resistance is at 77.54, followed by 77.73. The pair is expected to find support at 77.10 and the subsequent support level at 76.85.

With a series of Japan economic releases today, including Gross Domestic Product (GDP) and money supply, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.