Oil prices declined 1.66% against the USD for the 24 hour period ending 23:00GMT, closing at 107.38, amid a broad selloff, as Standard & Poor’s revised its long-term credit outlook for the United States to ‘Negative’ and Saudi Arabia trimmed output, citing oversupply and weak demand for its crude.

Investors today would focus on weekly data on US crude stockpiles from the Department of Energy to offer guidance to oil prices.

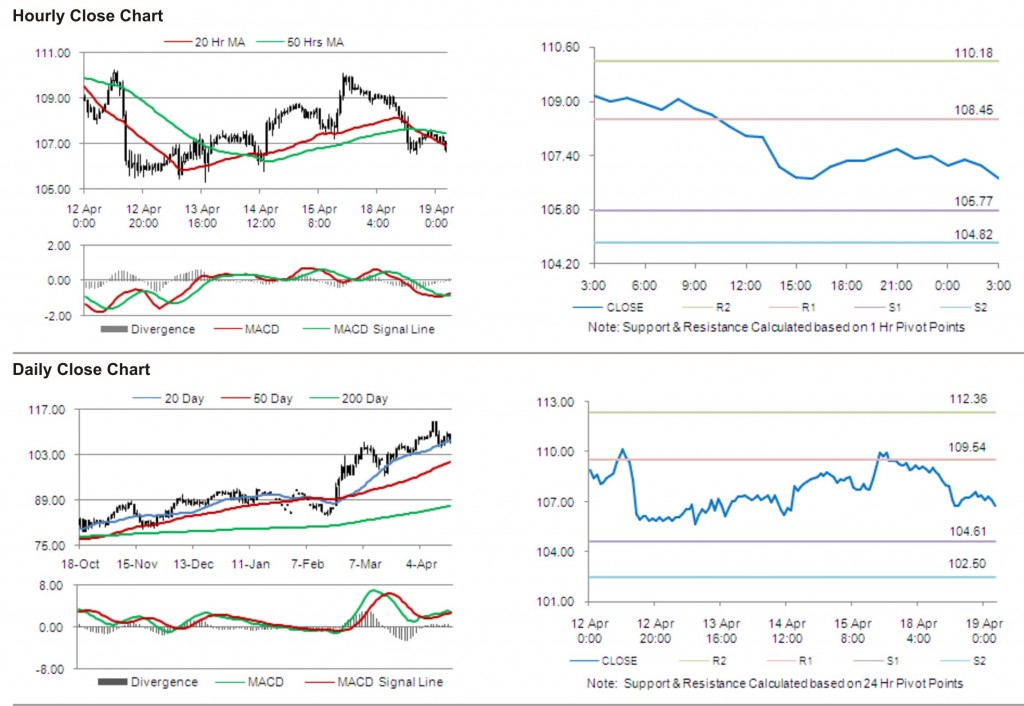

At GMT 0300, Oil is trading at USD 106.73 per barrel in the Asian session, 0.61% lower from 23:00GMT.

The pair has its first resistance at 108.45, followed by the next resistance at 110.18. On the other side, the first support is at 105.77, with the subsequent support at 104.82.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.