Oil prices declined 1.83% against the USD, on Friday, for the 24 hour period ending 23:00GMT, closing at 86.99, as hopes for a clear roadmap for solving the European debt crisis and energizing recovery in the US faded.

Investors shunned commodity risk, amid Europe’s deepening sovereign debt crisis, after European Central Bank executive board member, Juergen Stark, stepped down from his post, citing “personal reasons”. But investors speculated that his resignation came amid disagreements on the bank’s controversial bond-buying program.

Additionally, concerns over damage to US Gulf oil infrastructure eased after Tropical Storm Nate made landfall in central eastern Mexico over the weekend, with no other major weather disturbances expected to affect the hydrocarbon-rich region in the short term.

At GMT 0300, Oil is trading at USD 86.13 per barrel in the Asian session, 0.99% lower from 23:00GMT.

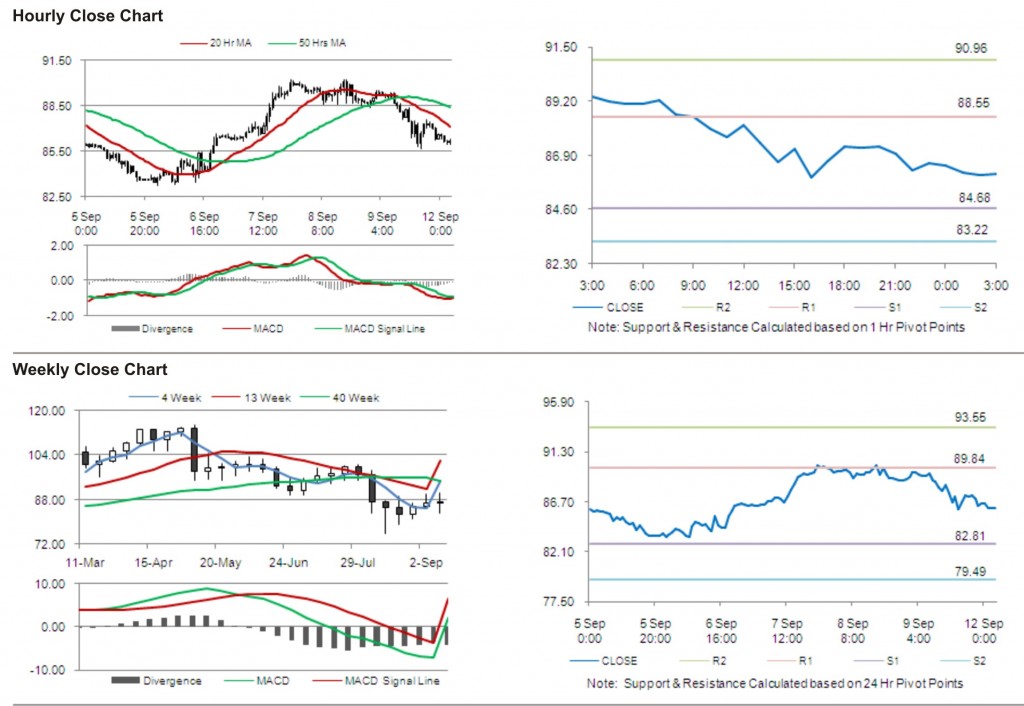

The pair has its first resistance at 88.55, followed by the next resistance at 90.96. On the other side, the first support is at 84.68, with the subsequent support at 83.22.

The pair is trading below its 20 Hr and its 50 Hr moving averages.