On Friday, Crude Oil prices declined 0.56% against the USD for the period ending 21:00GMT, closing at 102.92, as concerns on the supply-outlook of the commodity from the Russia-Ukraine region eased after Russia withdrew a majority of its military forces from the Ukrainian border. Oil prices also came under pressure after a survey by Reuters showed that OPEC’s oil production rose to a three-month high in May while another survey by the news agency projected crude oil prices to fall and average to $98.70 in the second-half of 2014, from its current year-to-date average of $99.93.

In the Asian session, at GMT0300, Crude Oil is trading at 103.14, 0.21% higher from Friday’s close, as a five-month high surge in China’s May NBS manufacturing PMI bolstered the demand-outlook of the commodity in the world’s second largest importer of crude oil.

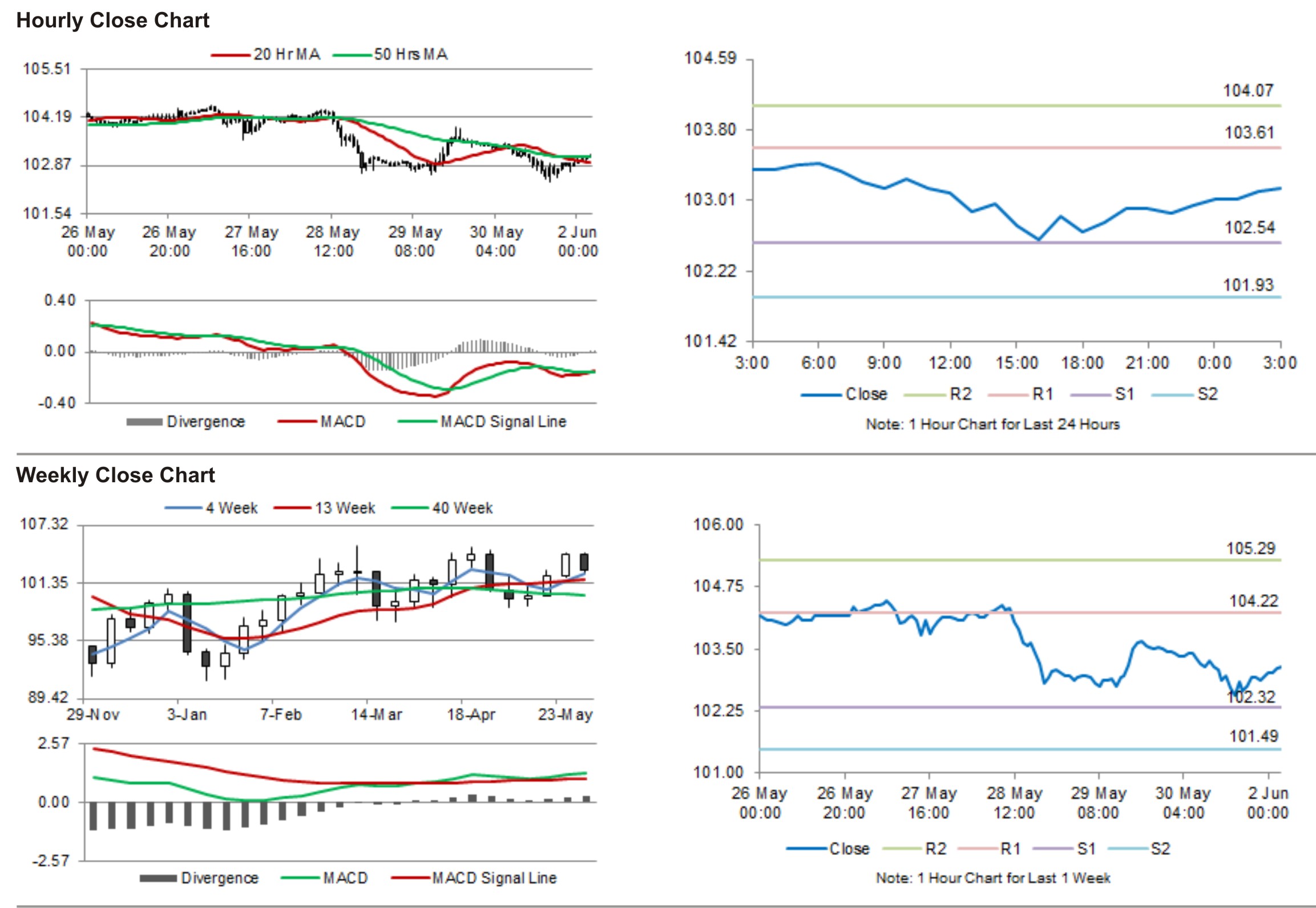

Crude oil is expected to find support at 102.54, and a fall through could take it to the next support level of 101.93. Crude oil is expected to find its first resistance at 103.61, and a rise through could take it to the next resistance level of 104.07.

Crude oil is trading just above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.