Crude Oil prices advanced 0.09% against the USD for the 24 hour period ending 23:00GMT, closing at 101.94, after the Energy Information Administration (EIA) reported that inventories at the Cushing, Oklahoma, delivery point fell the 14th time in 15 weeks by 592,000 barrels, last week. However, gains were pared after the EIA further revealed that crude stockpiles unexpectedly rose 900,000 barrels for the week ended May 9, as compared to analysts’ expectation for a decline of 1.5 million barrels. Separately, the EIA noted that the domestic crude oil production in the US last week registered its biggest rise since October 1986.

Negative sentiment was again fuelled after reports from Libya showed that its El Feel oilfield resumed operation yesterday as rebels agreed to end their blockade of the pipelines connecting the oil field to the port of Mellitah.

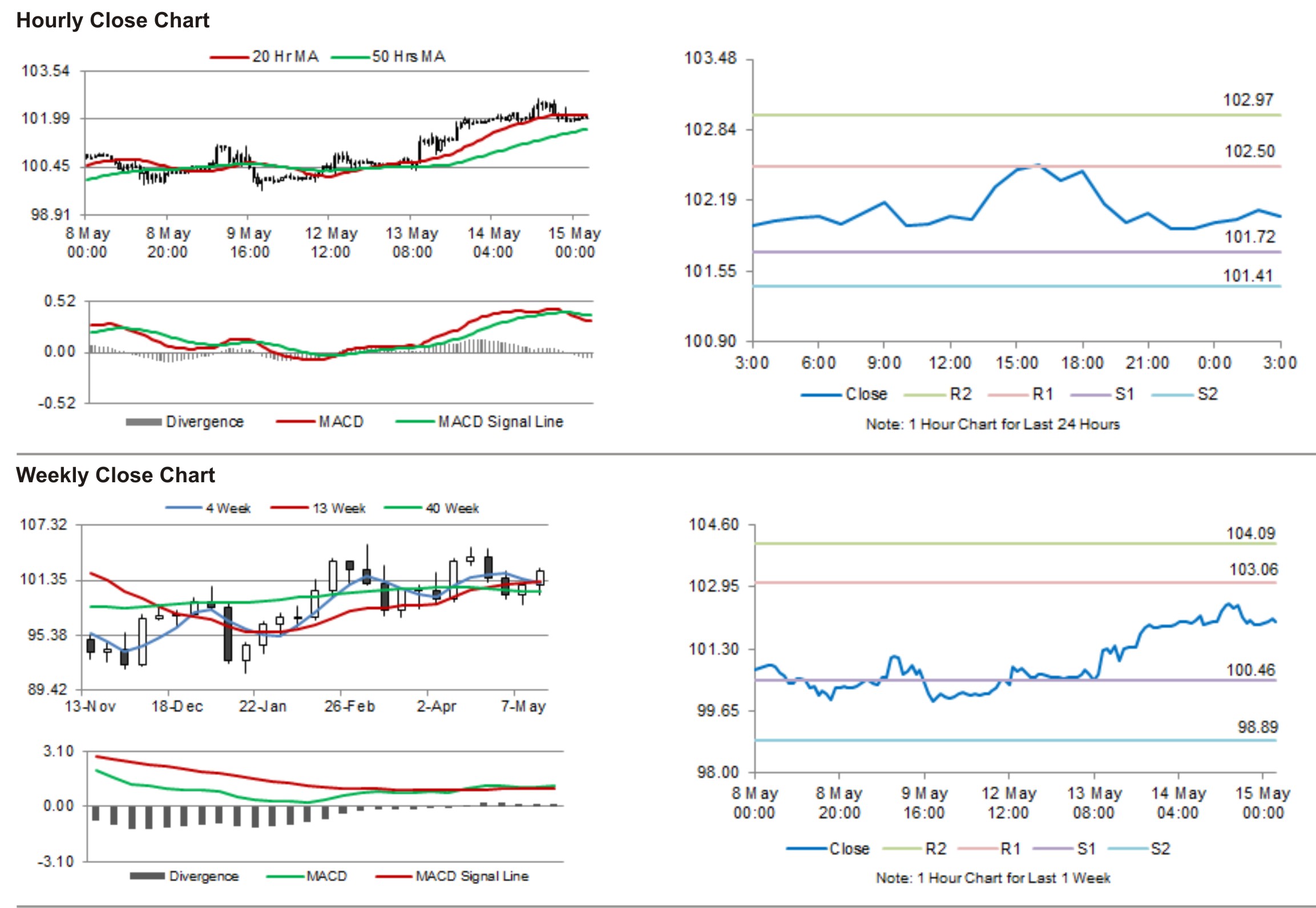

In the Asian session, at GMT0300, Crude Oil is trading at 102.04, 0.10% higher from yesterday’s close.

Crude oil is expected to find support at 101.72, and a fall through could take it to the next support level of 101.41. Crude oil is expected to find its first resistance at 102.50, and a rise through could take it to the next resistance level of 102.97.

Crude oil is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.