On Friday, Crude Oil prices declined 1.32% against the USD for the period ending 21:00GMT, closing at 94.21. However, the losses were capped after the Energy Information Administration (EIA) reported a 7 million barrels drop in the US crude supplies for the week ended December 27. Analysts had expected the crude supplies to fall by 1.5 million barrels.

In the Asian session, at GMT0400, Crude Oil is trading at 93.94, 0.29% lower from Friday’s close, after reports showed that the southern El Sharara oil field in Libya had restarted its production of 60,000 barrels per day and predicted the nation’s oil production to rise to 600,000 barrels a day, its highest since August.

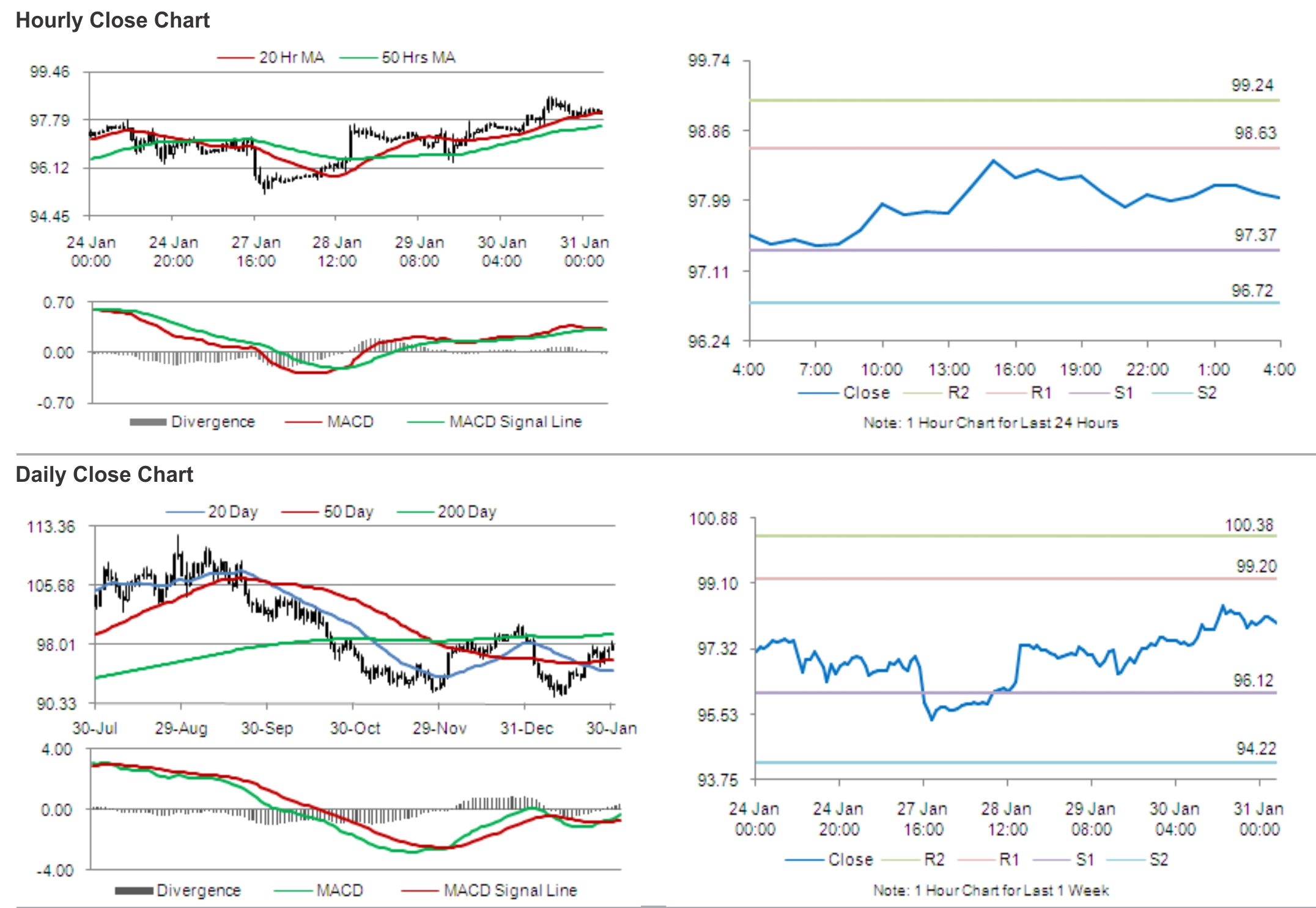

Crude oil is expected to find support at 93.32, and a fall through could take it to the next support level of 92.69. Crude oil is expected to find its first resistance at 95.11, and a rise through could take it to the next resistance level of 96.27.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.